We have observed a recent increase in State Revenue Office (SRO) investigations regarding payroll tax compliance.

News & Insights

Our latest news and insights

A collection of articles, case studies and media releases highlighting the latest in legal news and at Rigby Cooke Lawyers.

The Legal Language – Moral rights

Have you ever read something and thought, “I’m not sure what that means” or ‘is that really correct”? Welcome to our series of quickfire interviews that attempt to unravel those interesting words and phrases.

In this edition, we speak to Workplace Relations Associate Stephanie Shahine, who talks to us about the phrase she finds interesting, Moral rights.

The Full Federal Court addresses liability for duty payable on goods in licensed places

We have previously written on the difficult position of those operating and working in premises licensed by the Australian Border Force (ABF) for the holding of goods pending entry into home consumption, which goods are still treated as being subject to ‘customs control’.

Take that! Court turns the tables on oppressors by ordering majority buy-out

The Supreme Court of Victoria recently handed down its much-anticipated decision in Slea Pty Ltd v Connective Services Pty Ltd (No 9) [2022] VSC 136.

Who goes there? ABF to tighten the ‘fit and proper’ regime further

A version of this article was first published by The DCN in July 2022.

Customs & Trade law expert Andrew Hudson discusses the tightening of the ‘fit and proper’ regime at licensed places.

Reduced safety fine for Transport Company

On 22 May 2022, the Supreme Court of South Australia handed down a decision in Cleanaway Operations Pty Ltd v Phillip Hanel (Commonwealth: Comcare) [2022] SASC 52 upholding the conviction of Cleanaway Operations Pty Ltd (Cleanaway) for offences under section 32 of the Work Health and Safety Act 2011(Cth) (Act).

VCAT’s new Fast Track List is now in effect — here’s what you need to know

On 1 July 2022, the Victorian Civil & Administrative Tribunal (VCAT) introduced its new Fast Track List.

A mixed week for news on Free Trade Agreements in the northern hemisphere

A version of this article was first published by The DCN in July 2022.

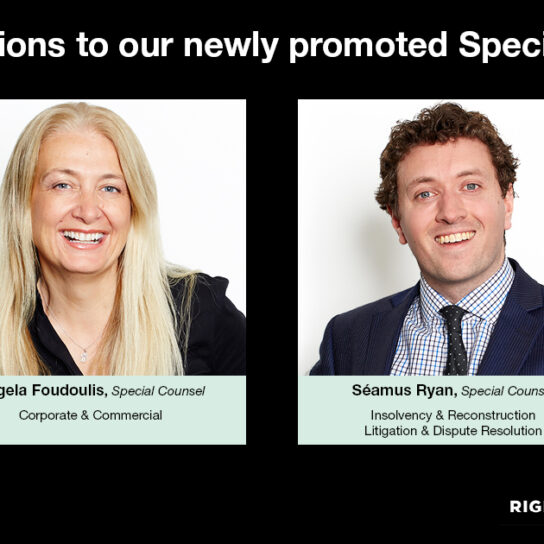

Angela Foudoulis and Séamus Ryan promoted to Special Counsel, effective 1 July 2022

Rigby Cooke Lawyers is delighted to announce the promotions of Angela Foudoulis and Séamus Ryan to Special Counsel, effective 1 July 2022.

New government’s proposed workplace relations reforms

The Australian Labor Party (ALP) proposed a number of amendments in the workplace and industrial relations space which, given the election outcome, the Albanese government is likely to pursue.

Preparing for 1 July 2022 (and beyond) – including wage and superannuation increases

On 15 June 2022, the Fair Work Commission handed down its 2022 Annual Wage Review decision.

The new framework of the Federal Government operating at the border

A version of this article was first published by The DCN in June 2022.

It is difficult to determine exactly what may arise now the election has taken place, given that there was minimal commentary on trade and border issues during the election campaign.

A post-election shopping list for Australian trade regulation

A version of this article was first published by The DCN in May 2022.

Andrew Hudson lists the important things the new federal government needs to pay attention to in the international trade space.

Misleading or deceptive conduct — one bad apple can spoil the bunch

In a recent decision1, the Supreme Court of Victoria has found that Viterra2 and its parent company Glencore3 engaged in misleading or deceptive conduct during their $420 million sale of a malting business, Joe White Maltings Pty Ltd (Joe White), to Cargill4.

Victorian Transport Association appoints Rigby Cooke Lawyers to provide WR/IR advisory service

We are delighted to share the news that our Workplace Relations team has recently been appointed by the Victorian Transport Association (VTA) to provide a workplace and industrial relations advisory service to members of the VTA and the Australian Road Transport Industrial Association (ARTIO).

The Legal Language – off-the-plan

Have you ever read something and thought, “I’m not sure what that means” or ‘is that really correct”? Welcome to our series of quickfire interviews that attempt to unravel those interesting words and phrases.

In this edition, we speak to Property Lawyer Biljana Stankovski, who talks to us about the phrase she finds interesting, off-the-plan.

ATO cracking down on director penalties

The Australian Tax Office (ATO) is ramping up its collection of overdue tax payments, including by serving Director Penalty Notices (DPNs) which were largely held in abeyance during the COVID-19 pandemic.

FWC provisional view – 10-day paid family and domestic violence leave entitlement

The Full Bench of the Fair Work Commission (FWC) formed the provisional view on 16 May 2022 that modern awards should contain an entitlement to 10 days of paid family and domestic violence leave (FDV).

Legal professional privilege and poker – never show your hand too early

The Federal Court recently handed down a decision in respect of the attempt by TerraCom, an Australian resources and energy company, to seek a declaration that a report seized by the Australian Securities and Investments Commission (ASIC) during an investigation was subject to legal professional privilege (Report).

Significant developments in the Australian free-trade agenda

A version of this article was first published by The DCN in May 2022.

Customs & Trade law expert Andrew Hudson provides a summary of recent and still-under-negotiation trade pacts and analyses their significance.

The Legal Life – meet Alexander Uskhopov

Alexander Uskhopov is a Lawyer in our Customs & Trade team.

Alexander shares his goals for 2022 and his career highlight to date.

The Legal Language – Caveat emptor

Have you ever read something and thought, “I’m not sure what that means” or ‘is that really correct”? Welcome to our series of quickfire interviews that attempt to unravel those interesting words and phrases.

In this edition, we speak to Property Partner Tim Kelly, who talks to us about the phrase he finds interesting, Caveat emptor.

Best Lawyer recognition for Rigby Cooke Partners

Rigby Cooke is pleased to announce that for the third consecutive year, two of our Partners, Andrew Hudson and David McLaughlin, have been included in their respective areas in the Best Lawyers in Australia rankings for 2023.

The war in Ukraine and its effect on international trade

A version of this article was first published by The DCN in April 2022.

Please note that this was prepared in the middle of March 2022, before our other updates on more recent developments in sanctions and trade controls. It is provided by way of providing more detail on the background on the basis for these measures.

The war in Ukraine is upending world trade, and there is no sign of an end to the disruption, Andrew Hudson writes.

Australian sanctions and controls against Russia escalate and evolve

A version of this article was first published by The DCN on 4 April 2022. This version incudes new and updated information.

I have previously written regarding fundamental changes to Australia’s sanctions regime, from implementing United Nations (UN) sanctions through to the adoption of our own Autonomous Sanctions and more lately, the creation of the new Thematic Sanctions.

The Legal Language – intermeddling

Have you ever read something and thought, “I’m not sure what that means” or ‘is that really correct”? Welcome to our series of quickfire interviews that attempt to unravel those interesting words and phrases.

In this edition, we speak to Wills, Trusts & Estates Special Counsel Christian Teese, who talks to us about the word he finds interesting, intermeddling.

At long last, Australia seals a preliminary Free Trade Agreement with India

A version of this article was first published by The DCN in April 2022.

After a long series of false starts, Australia and India have finally completed the first stage of a two-stage process that will result in a full Australia-India Comprehensive Economic Cooperation Agreement (AICEPA) towards the end of 2022.

Federal Budget 2022-23 – overview of customs and trade related measures

On 29 March 2022, the Treasurer handed down the Australian Federal Budget for 2022-23 (Budget).

Federal Budget 2022-23 – overview of taxation measures

On 29 March 2022, the Treasurer handed down the Federal Budget for 2022-23.

The Legal Language – Sign

Have you ever read something and thought, “I’m not sure what that means” or ‘is that really correct”? Welcome to our series of quickfire interviews that attempt to unravel those interesting words and phrases.

In this edition, we speak to Corporate & Commercial Partner and Intellectual Property practice lead Ian Rosenfeld, who talks to us about the word he finds interesting, sign.

Bucket companies and sub-trusts – no longer a guaranteed shield against Division 7A

Almost 6 years ago, as part of the 2016-17 Federal Budget, the Government announced that it would make amendments to improve the operation of Division 7A of the Income Tax Assessment Act 1936 (ITAA 1936). The Government reiterated this intention in the 2018-19 Federal Budget, also clarifying that it will ensure that unpaid present entitlements (UPEs) come within the scope of Division 7A.

The Legal Language – forfeiture

Have you ever read something and thought, “I’m not sure what that means” or ‘is that really correct”? Welcome to our series of quickfire interviews that attempt to unravel those interesting words and phrases.

In this edition, we speak to Wills, Trusts & Estates Associate Marcus Schivo, who talks to us about the word he finds interesting, forfeiture.

The rise of ESG issues in the supply chain

A version of this article was first published by The DCN in March 2022.

Customs & Trade law expert Andrew Hudson takes a look at the increasing importance of environmental, social and governance (ESG) considerations and the consequences for industry.

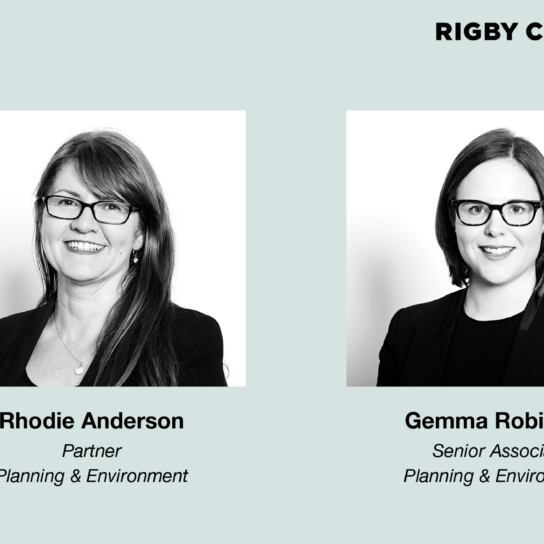

Rigby Cooke Lawyers Planning & Environment team receive Doyles Guide recognition

Rigby Cooke Lawyers’ Planning & Environment team have again been recognised for their exceptional work in the Victorian planning space.

Electronic signing here to stay – at last

- Temporary measures to allow for virtual meetings, electronic signing and distribution of corporate documents by corporations have been permanently enacted.

- Additional changes have been introduced to modernise and update the Corporations Act 2001 (Corporations Act).

Doyles Guide recognition for Rigby Cooke Lawyers Workplace Relations team

Rigby Cooke Lawyers is pleased to announce that our Workplace Relations team has again been recognised for their outstanding work in Employment Law in Victoria.

Sanctions here, there and everywhere – the consequences of the Ukraine crisis

The Russian military invasion of Ukraine has met almost universal opposition and condemnation from around the world through commentary, protest and by way of the imposition of economic sanctions and other restrictions by countries, including by Australia.

Who’s Who Legal recognition for Andrew Hudson

Rigby Cooke Lawyers’ Partner Andrew Hudson has been recognised by Who’s Who Legal (WWL) for the second consecutive year as a “Recommended Lawyer” in their Global Trade & Customs list 2021.

The evolution of our trade agenda – The past 130 years

A version of this article was first published by The DCN in February 2022 as part of the 130th Anniversary of its first edition.

Customs & Trade lawyer Andrew Hudson takes a look at how the laws governing trade in Australia have grown and changed over the years.

It all depends on the written contract

Two related decisions handed down by the High Court of Australia on Wednesday 9 February 2022 continue the approach of the Court enunciated in the Workpac v Rossato [2021] HCA 23 (Rossato) decision handed down last year giving primacy to the terms of the written contract to determine the nature of the relationship between the parties.

Commercial Tenancy Relief Scheme 2022

Further to our previous alerts, the Commercial Tenancy Relief Scheme is now extended to cover the period from 16 January 2022 to 15 March 2022.

Advance Care Directives – do I need one?

An Advance Care Directive (ACD) allows you to plan for your medical treatment when you do not have the capacity to consent to or refuse medical treatment.

The Legal Language – Effluxion of time

Have you ever read something and thought, “I’m not sure what that means” or “is that really correct”? Welcome to our series of quickfire interviews that attempt to unravel those interesting words and phrases.

In this edition, we speak to Workplace Relations Senior Consultant Sam Eichenbaum, who talks to us about the phrase he finds interesting, Effluxion of time.

Extension of Victorian Mandatory Vaccination requirements and booster shot requirements

The Victorian Government has again extended Mandatory Vaccination requirements for workers and operators of specified facilities from 11.59pm 12 January 2022 under the Pandemic Orders1.

What sanction reform means for your business

A version of this article was first published by The DCN in January 2022.

Andrew Hudson explains what the thematic sanctions reforms passed by the Australian Parliament means for your business.

The AUKFTA is completed and signed – now for comprehension and implementation

Back in June 2021, I provided an update regarding the release of the “Agreement in Principle” between Australia and the United Kingdom (UK) as to the proposed content of the Australia-United Kingdom Free Trade Agreement (AUKFTA). The intent of releasing the “Agreement in Principle” was to demonstrate early outcomes from negotiations for the AUKFTA and maintain interest in both countries.

Victorian Mandatory Vaccination requirements extended under Pandemic Orders

The Victorian Government has now extended Mandatory Vaccination requirements for workers until 12 January 2022 under the new suite of Pandemic Orders1.

Mental health and wellbeing surcharge commencing from 1 January 2022

The payroll tax liability of many Victorian businesses is set to increase due to the introduction of the Mental Health and Wellbeing Payroll Tax Surcharge (the surcharge) from 1 January 2022.

What else is in the customs and trade waiting room for 2022?

A version of this article was first published in DCN Magazine in December 2021.

Customs & Trade law expert Andrew Hudson takes a deep dive into what developments are on the horizon for the new year.

Windfall Gains Tax is now law

The Windfall Gains Tax and State Taxation and Other Acts Further Amendment Act 2021 (the Act) received Royal Assent on 30 November 2021.

Payroll tax risks for Medical, Dental and Allied Health Providers… And more?

A recent decision of the NSW Civil and Administrative Tribunal (NCAT) is anticipated to increase the risk of payroll tax audits of medical and healthcare practices which use service entities to provide administrative services to practitioners.

HR Hot Tip – new powers of the FWC in hearing sexual harassment matters

Welcome to our series of HR interviews with Workplace Relations Associate Stephanie Shahine, who answers some of the most commonly asked questions by HR managers regarding employees’ legal entitlements and employers’ health and safety requirements.

New “Forced Labour” Bill introduced in the House of Representatives

We have previously written on the topic of legislation and practice overseas (especially the United States) enabling goods produced by “forced labour” to be seized at the border and destroyed.

Have you appointed the best person to manage your financial affairs?

Who and how to appoint your attorneys.

Changes to Victoria’s Mandatory Vaccination exemption requirements

Under the new COVID-19 Mandatory Vaccination (Workers) Directions (Directions) issued on 18 November, workers are now required to provide a current COVID-19 digital certificate as ‘acceptable certification’ to prove an exemption from the Mandatory Vaccination requirements (Vaccination Requirements).

I want to end my Life Interest

Surrendering a life interest – beware the tax implications

A common method to ensure that a family member or spouse of a Willmaker will have the right to reside at a particular property for the rest of their lifetime is for the Willmaker to grant a ‘life interest’ to that individual.

1 January 2022 – a new year is not fun for everyone!

Many people look forward to a new year as a time for celebration. However, for importers and exporters and their service providers, including licensed customs brokers and freight forwarders, the start of the 2022 new year is a time to pay close attention to some significant changes to their regulatory regime.

New proof of COVID-19 vaccination medical exemption requirements in Victoria

Effective from 6pm on Friday 12 November 2021, Victorian employers must sight more than a medical certificate to establish that a worker is exempt from the mandatory vaccination requirements (Vaccination Requirements).

Are you ready for the superannuation stapling obligations starting Monday 1 November?

What is the requirement?

From Monday 1 November 2021, if a new onboarding employee does not nominate a preferred superannuation fund (using the Standard Choice Form), the employer is required to ask the Australian Taxation Office (ATO) if there is already a superannuation account linked (stapled) to that employee. If the employee has a stapled fund, the employer must make superannuation contributions to that fund rather than the employer’s default fund.

Director Identification Number – changes to the regime

Under changes to the Treasury Laws Amendment (Registries Modernisation and Other Measures) Act 2020 (Cth) introduced in June 2021, all directors will be required to verify their identity as part of a new Director Identification Number (director ID) requirement.

The Windfall Gains Tax is on the way

During the 2021 Victorian State Budget, the Government announced that it would introduce a ‘windfall gains tax’ (WGT) that would apply to large windfall gains associated with planning decisions to rezone land.

Signing your Will over the internet is here to stay

During the COVID lockdown last year, the Victorian Government passed emergency legislation to deal with the execution of many legal documents, including Wills and Powers of Attorney. The legislation legalised the electronic signing and witnessing of such documents.

Legislation proposed for the construction of the ABF’s “Regulatory Sandbox”

Many of you would be aware that one of my professional dreams is for the Customs Act 1901 (Act) to be replaced with a new version written to modern regulatory standards. Those affected would not be relying on legislation whose origins stretch back to Federation (and even from the States Customs Acts before Federation).

The Legal Language – Zombie Agreement

Have you ever read something and thought, “I’m not sure what that means” or “is that really correct”? Welcome to our series of quickfire interviews that attempt to unravel those interesting words and phrases.

In this edition, we speak to Workplace Relations Special Counsel Victoria Comino who talks to us about the phrase she finds interesting, Zombie Agreement.

The implementation of the RCEP comes ever closer

This article was first published in October by The Daily Cargo News.

The fact that the Regional Comprehensive Economic Partnership Agreement (RCEP) has survived the COVID-19 pandemic and the apparent shift towards enhanced protectionism indicates that the parties still believe that there is merit in a rules-based multilateral agreement to facilitate trade.

Mandatory Vaccination Directions for Victorian workers released

Following an announcement by the Premier on Friday 1 October, the Victorian Acting Chief Health Officer has now issued Mandatory Vaccination Directions (Directions) that apply to select workers1 (previously referred to as authorised workers) except those in specific industry groups of healthcare, aged care, construction and education.

Vaccination status and the Privacy Act

- Businesses must remember their privacy obligations when collecting vaccination status information (and other sensitive information) about employees, contractors and other visitors to the workplace.

- Unless collection is required or authorised by law, informed consent is generally required for the collection of sensitive information.

- Businesses must provide a Collection Notice to all individuals, including employees, even if consent to collection is not required.

- Only the minimum amount of personal information reasonably necessary to prevent or manage COVID-19 or required by law should be collected, used or disclosed.

HR Hot Tip – casual employees, changes to the IR Omnibus bill, and the new information statements.

Welcome to our series of HR interviews with Workplace Relations Associate Stephanie Shahine, who answers some of the most commonly asked questions by HR managers regarding employees’ legal entitlements and employers’ health and safety requirements.

Mandatory Vaccinations for all Victorian authorised workers

On Friday 1 October, the Victorian Premier announced new rules in relation to vaccination requirements for workers attending workplaces.

A question of notice: employment contract’s implied term of reasonable notice versus the Fair Work Act’s notice provisions

This article was first published in September 2021 by Employment Law Bulletin.

The risks of nominating and land development

The State Revenue Office (SRO) has released a revenue ruling (DA-064) which sets out its views on the meaning of ‘land development’ in the context of the sub-sale provisions.

HR Hot Tip – Victorian wage theft laws. What does it mean for employers?

Welcome to our series of HR interviews with Workplace Relations Associate Stephanie Shahine, who answers some of the most commonly asked questions by HR managers regarding employees’ legal entitlements and employers’ health and safety requirements.

The Legal Language – smuggling

Have you ever read something and thought, “I’m not sure what that means” or “is that really correct”? Welcome to our series of quickfire interviews that attempt to unravel those interesting words and phrases.

In this edition, we speak to Customs & Trade Partner Andrew Hudson who talks to us about the word he finds interesting, smuggling.

Doyles Guide recognition for Rigby Cooke Lawyers Wills, Trusts & Estates team

Rigby Cooke Lawyers is pleased to announce that our Wills, Trusts and Estates team have again been recognised for their exceptional work in Victoria.

Summary of the Commercial Tenancy Relief Scheme Regulations 2021

The Victorian government has continued the Commercial Tenancy Rent Relief Scheme Regulations 2021 (the Regulations) by enacting new regulations to account for the extended lockdown experienced by commercial tenants in Victoria.

Commercial Tenancy Relief Scheme Regulations

Further to our previous alerts (see here and here), the Victorian Government has now introduced regulations to accompany the legislation governing the Commercial Tenancy Relief Scheme (CTRS).

Full-blood or half-blood does it matter?

The entitlement of half-siblings upon intestacy made clear again.

To gift or not to gift

The case of Kennedy v Proctor [2021 VSC 521] concerns a dispute as to whether a horse known as ‘Ishker’ was loaned or gifted by Ms Kennedy to Ms Proctor. It was a decision appealed from the Magistrates’ Court to the Court of Appeal.

New powers for FWC to deal with sexual harassment issues

In a partial implementation of the recommendations arising from the Sex Discrimination Commissioner’s Respect@Work report, the Federal Parliament has passed the Sex Discrimination and Fair Work (Respect at Work) Amendment Bill 2021. The Act will commence when it receives Royal Assent which is expected to occur in the coming days.

The Legal Language – personal chattels

Have you ever read something and thought, “I’m not sure what that means” or “is that really correct”? Welcome to our series of quickfire interviews that attempt to unravel those interesting words and phrases.

In this edition, we speak to Wills, Trusts & Estates Partner Rachael Grabovic, who talks to us about the phrase, personal chattels.

Rossato – the High Court says ‘casual’ means ‘casual’

Businesses, large and small, rely on casual employees to provide flexibility to cater for erratic changes in trading conditions.

Protecting your innovation and IP

This article was first published on 2 August 2021 by AMTIL.

Forward looking businesses know innovation is vital to securing a competitive advantage within their chosen industry. But how does a business ensure that it retains the intellectual property (IP) rights in their innovation?

GST on low–value imports held to account

Many of those in industry will remember the controversy associated with the introduction of Goods and Services Tax (GST) on “low-value import transactions” (LVT) on consignments three years ago.

The Legal Life – meet Biljana Stankovski

Biljana Stankovski is a Lawyer in our Property team.

Biljana shares her goals for the remainder of 2021 and her favourite holiday spot.

HR Hot Tip – Do I have to pay superannuation to contractors and does the super guarantee percentage apply?

Welcome to our series of HR interviews with Workplace Relations Associate Stephanie Shahine, who answers some of the most commonly asked questions by HR managers regarding employees’ legal entitlements and employers’ health and safety requirements.

The AUKFTA – not a Tim Tam for Penguin biscuit exchange

This article was first published in July 2021 by DCN.

Andrew Hudson takes us on a deep dive into the Australia-UK Free Trade Agreement (AUKFTA), examining what it means for Aussie importers and exporters.

Don’t worry – those Olympic medals aren’t subject to import duty

This article was first published on 5 August 2021 by DCN.

Only a Customs & Trade lawyer nerd who also happens to be a sports tragic would start to think about whether customs duty or Goods and Services Tax is payable on Olympic medals when brought into Australia. It would be unfortunate for the winners of the medals to try and establish the value of the medals and then whether customs duty is payable.

Commercial Tenancy Relief Scheme update

Further to our recent alert, the Victorian Government has introduced new legislation regarding the Commercial Tenancy Relief Scheme (CTRS).

Freight company hit with fine for back-payment contravention

On 26 July 2021, the Fair Work Ombudsman (FWO) successfully secured a pecuniary penalty of $21,500 in the Federal Circuit Court against the operator of a long-haul trucking business based in Melbourne for failing to comply with a Compliance Notice requiring back-payments of entitlements to a former truck driver.

New COVID relief package announced

On 28 July 2021, the Commonwealth and Victorian Governments presented new recovery packages for small businesses. The new support packages will offer $400 million in support to small businesses to be funded equally between the Commonwealth and Victorian Governments.

Misleading or deceptive claims in advertising

In a high-profile reminder that claims made in advertising need to be properly substantiated and supported by evidence, the Federal Court has ordered Lorna Jane to pay $5 million in penalties for making false and misleading representations to consumers, and engaging in conduct liable to mislead the public, in connection with its “LJ Shield Activewear”.

HR Hot Tip – Flexible working arrangements. Who can request them?

Welcome to our series of HR interviews with Associate Stephanie Shahine, who answers some of the most common questions asked by HR managers regarding employees’ legal entitlements and employers’ health and safety requirements, especially as business begins to transition back into the office.

The Legal Language – cloning

Have you ever read something and thought, “I’m not sure what that means” or “is that really correct”? Welcome to our series of quickfire interviews that attempt to unravel those interesting words and phrases.

In this edition, we speak to Tax Counsel Tamara Cardan who talks to us about the word she finds interesting, which has multiple definitions, cloning.

The continuing compliance agenda for Australian trade

This article was first published in July 2021 by The Daily Cargo News.

Customs & Trade law specialist Andrew Hudson offers some thoughts on the compliance focus of some of Australia’s border agencies.

Ensure promotional material complies with Australian Consumer Law

This article was first published on 29 June 2021 by AMTIL.

Regardless of how you promote products and services to consumers, it is critical to ensure that all product packaging, advertising materials and marketing collateral complies with Australian Consumer Law (ACL), explain Ian Rosenfeld, Emma Simpson and Ian Liu.

Superannuation Guarantee Contributions

As we look towards the start of the new financial year, 1 July 2021 will see the Superannuation Guarantee (SG) rate increase from 9.5% to 10% and continue to increase annually until it reaches 12% on 1 July 2025.

The ongoing Australian trade agenda response to the COVID–19 pandemic. Open for business even with borders closed

This article was first published in June 2021 by Thomson Reuters Canada.

Despite the optimism surfacing in some quarters that the world and its economy are recovering from the COVID-19 Pandemic, recovery is far from complete and the consequences will continue to affect the world for many years. This article provides some insight into how Australia’s trade has coped and the shape of its recovery – with a little help from its friends.

Preparing for 1 July 2021 (and beyond) – including wage and superannuation increases

Annual Wage Review Decision

On 16 June 2021, the Fair Work Commission handed down its 2021 Annual Wage Review Decision.

HR Hot Tip – Is the employer obliged to set up office equipment at home as well as at the office?

Welcome to our series of HR interviews with Associate Stephanie Shahine, who answers some of the most common questions asked by HR managers regarding employees’ legal entitlements and employers’ health and safety requirements, especially as business begins to transition back into the office.

Senate report pushes for restrictions on imported goods produced by forced labour

This article was first published on 22 June 2021 by Daily Cargo News.

Concerns for human rights have manifested themselves in many ways over the course of many years and led to a range of responses over that time, whether by unilateral national action or collective international action through such bodies as the United Nations Human Rights Council.