In recent months, we have observed that commercial waste management companies are increasingly using standard form contracts containing unfair terms. Notably, these unfair terms (specifically in waste management agreements) were declared to be unfair in the case of ACCC v JJ Richards [2017] FCA 1224.

Category: Corporate & Commercial

Our latest news and insights

A collection of articles, case studies and media releases highlighting the latest in legal news and at Rigby Cooke Lawyers.

Prevention is better than cure — navigating shareholder disputes in the transport and logistics industry

Shareholder disputes affect companies of all sizes across all industries in Australia and are far more common than you might think. The transport and logistics industry is certainly not immune.

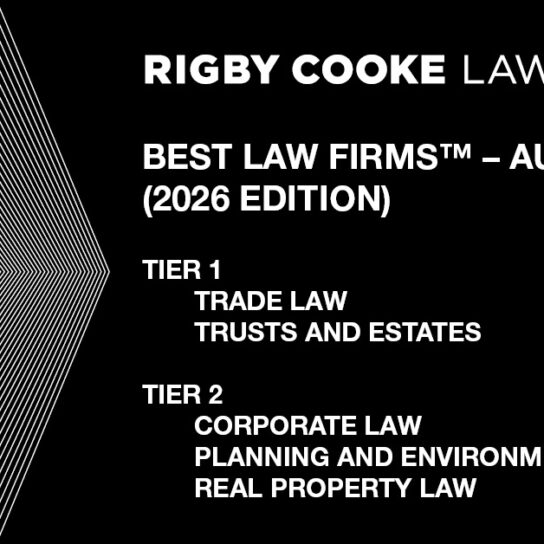

Rigby Cooke Lawyers recognised in Best Law Firms™ – Australia (2026 Edition)

Rigby Cooke Lawyers is delighted to share that we have been recognised among the best law firms in Melbourne for five areas of law in the second edition of Best Law Firms™ – Australia.

Businesses beware — individuals can now claim damages for a serious invasion of privacy

In late 2024, the Privacy and Other Legislation Amendment Act 2024 (Cth) introduced a new statutory tort for serious invasion of privacy. This development marks a significant evolution in the Australian privacy law legal landscape, providing individuals with a clear and actionable right to seek redress for serious breaches of their privacy. It reflects growing public concern over personal information misuse and affirms the importance and value placed on privacy protection.

In this article, we explain the elements of the new tort of the serious invasion of privacy, the defences available for defendants and the damages available to complainants.

Avoiding common disputes in contractual dealings

Contracts are the foundation upon which legal rights, obligations and expectations are built. The essential function of a contract is to create a binding legal relationship between contracting parties. In theory, they are designed to clearly define the mutual understanding and commitments made by the contracting parties. However, in practice, this clarity is not always reflected in the final contract terms. This can lead to unnecessary disputes, often resulting in protracted and costly litigation.

Six Rigby Cooke Lawyers’ partners named in 2026 edition of The Best Lawyers in Australia™

Rigby Cooke Lawyers is delighted to share that six of our esteemed partners have been recognised across eight areas of law in the 2026 edition of The Best Lawyers in Australia™.

ATO warns of increasing risk of director penalty notices — what you need to know

The last 12 months has seen an escalation in debt collection activities instigated by the Australian Taxation Office (ATO) with respect to businesses, resulting in a subsequent increase in the rate of insolvencies. Where the ATO is unable to recover a tax debt directly from a company due to liquidity issues, it can seek to recover those debts personally from directors, via the director penalty regime.

Tamara Cardan appointed to Property Council’s Victorian Tax and Economic Trends Committee for 2025/2026

Rigby Cooke Lawyers’ Tamara Cardan, Special Counsel in our Corporate & Commercial and Tax teams has been appointed as a committee member of the Property Council of Australia’s Tax and Economic Trends committee in Victoria.

Introducing Brighid Virtue, Associate in our Corporate & Commercial group

We are delighted to introduce Brighid Virtue, Associate in our Corporate & Commercial group.

Rigby Cooke Lawyers advises Stannards on its partnership with Pemba Capital Partners

Rigby Cooke Lawyers advised Stannards, a leading accounting and business advisory firm, on its partnership with Pemba Capital Partners (Pemba), a prominent investor in high-growth, entrepreneurial businesses.

Can I exclude all liability in a contract?

As a transport and logistics operator, while you cannot exclude all liability, you can limit your liability.

Trying to exclude all liability is extremely high-risk, if not impossible.

What the transport and logistics industry needs to know about the updated unfair contract terms regime

The Unfair Contract Terms (UCT) regime has been updated to broaden its application and impose penalties for breach and has been in effect since 9 November 2023.

Australian Government announces the launch of the Administrative Review Tribunal

In a significant development for Australia’s administrative review landscape, the Australian Government has unveiled plans to launch the Administrative Review Tribunal (ART) on 14 October, 2024.

This newly established federal body will replace the existing Administrative Appeals Tribunal (AAT), thereby implementing the Labor Government’s election promise to address what were seen as biased political appointments within the AAT.

Rigby Cooke Lawyers promotes eight lawyers, including Victoria Comino and Christian Teese to partner, effective 1 July 2024

Rigby Cooke Lawyers is delighted to announce the promotion of eight lawyers across five practice areas.

Rigby Cooke Lawyers recognised in Best Law Firms™ – Australia

We are pleased to share the news that five of our practice areas, including Corporate & Commercial, Customs & Trade, Planning & Environment, Property and Wills, Trusts & Estates, have been recognised by Best Lawyers in their inaugural edition of Best Law Firms™ – Australia.

Ruby Princess High Court decision confirms that UCT laws extend beyond Australia’s borders

Case note: Karpik v Carnival plc [2023] HCA 39

In the recent class action case, Karpik v Carnival plc [2023] HCA 39 (Ruby Princess Case), the High Court of Australia has confirmed that where at least one party to a standard contract for goods or services is acting within, or carrying out business in, Australia the unfair contract term (UCT) laws will apply to that contract.

Rigby Cooke Lawyers’ partners named in the 17th edition of The Best Lawyers in Australia™

We are pleased to announce that five of our esteemed partners have been recognised in the 17th edition of The Best Lawyers in Australia™.

Strengthened unfair contract term laws — what does it mean for you?

Businesses using standard form contracts — including trading terms and conditions, online click-through agreements and independent contractor agreements that are not routinely negotiated — are at risk of breaching strengthened unfair contract term (UCT) laws under the Australian Consumer Law (ACL) which came into force on 9 November 2023.

Congratulations Julia Cameron and Lindy Muto – winners in the Lawyers Weekly Women in Law Awards 2023

We are delighted to share the news that Rigby Cooke Lawyers’ Julia Cameron, Partner – Corporate & Commercial, and Lindy Muto, Head of Legal Operations, were successful in the Lawyers Weekly Women in Law Awards 2023 held last Thursday at the Palladium at Crown, Melbourne.

Unfair terms and the transport and logistics industry

The Unfair Contract Terms (UCT) regime is being updated to broaden its application and impose penalties for breach.

Congratulations Julia Cameron and Lindy Muto – finalists in the Lawyers Weekly Women in Law Awards 2023

We are delighted to share the news that Rigby Cooke Lawyers’ Julia Cameron, Partner in our Corporate & Commercial group, and Lindy Muto, Head of Legal Operations, have been named as finalists in the Lawyers Weekly Women in Law Awards 2023.

Perfecting your interests: Why registration on the PPSR is important for manufacturers

A version of this article was first published by AMTIL in August 2023.

The Personal Property Security Act 2009 (PPSA) came into effect in 2012 and created a uniform regime for parties to register security interests. It replaced over seventy pieces of individual legislation around Australia and aimed to give certainty with respect to the priority of security interests where a grantor enters external administration.

Victorian Budget 2023-24 – Overview of significant measures

On 23 May 2023, the Victorian Government delivered the State Budget.

Detailed below is a summary of the significant tax measures and a consideration of the announced measures in greater detail.

Changes to the Unfair Contract Terms regime with increased penalties from 9 November — here’s what you need to know!

The Unfair Contract Terms regime (UCT) is intended to prevent businesses with a stronger bargaining position from relying on unfair terms in standard form contracts with consumers and/or small businesses.

Six partners from Rigby Cooke Lawyers named in the 16th edition of The Best Lawyers in Australia™

Rigby Cooke Lawyers is pleased to announce that six of our esteemed partners across six practice areas have been recognised in the 16th edition of The Best Lawyers in Australia™.

What amounts to an enforceable contract in settlement discussions? Recent case law involving the principles of Masters v Cameron

During settlement discussions, it is commonplace for offers and counteroffers to be made between rival parties. While settlement offers are usually reduced to writing in a letter or formal Offer of Compromise, they are often communicated verbally or via email. These seemingly ‘less formal’ modes of communication can create a situation where one party asserts that a legally enforceable settlement agreement has been made, while the other says it has not.

Restraint of trade clauses and urgent injunctions

Case note: Airmaster Corporation Pty Ltd v Mohtadi [2022] VSC 822

Rigby Cooke Lawyers advises hotel investor in acquisition of the Lyall Hotel and Spa

Rigby Cooke Lawyers’ Corporate & Commercial group advised hotel investor and developer, Mazen Tabet and the Tabet Group, in the successful acquisition of the Lyall Hotel and Spa in South Yarra.

It’s time to review your standard-form contracts for unfair terms

There is now less than 12 months to review your business’s standard-form contracts for unfair contract terms (UCTs) to avoid contravention of the Australian Consumer Law in Schedule 2 of the Competition and Consumer Act 2010.

Federal Budget 2022-23 — New tax measures announced

On 25 October 2022, Federal Treasurer Jim Chalmers handed down the Budget of the newly elected Government for 2022-23.

Federal Court raises the bar in cybersecurity accountability

The Federal Court’s recent landmark decision in ASIC v RI Advice Group Pty Ltd [2022] FCA 4961 raises the bar for companies and directors on the importance of adequate cybersecurity protection after it imposed costly remedial orders on a financial services provider for failing to maintain adequate cybersecurity risk management systems.

Have you got your director ID yet?

- Prospective directors must obtain a director ID number before appointment.

- Existing directors must obtain their director ID numbers by 30 November 2022.

Is your company eligible to access the reduced corporate tax rate?

The Federal Government’s ‘Enterprise Tax Plan’ has seen a gradual reduction in the corporate tax rate applying to small and medium-sized companies over recent years. The reduced corporate rates were previously 27.5% from the 2017-18 to 2019-20 income years, and 26% in the 2020-21 income year.

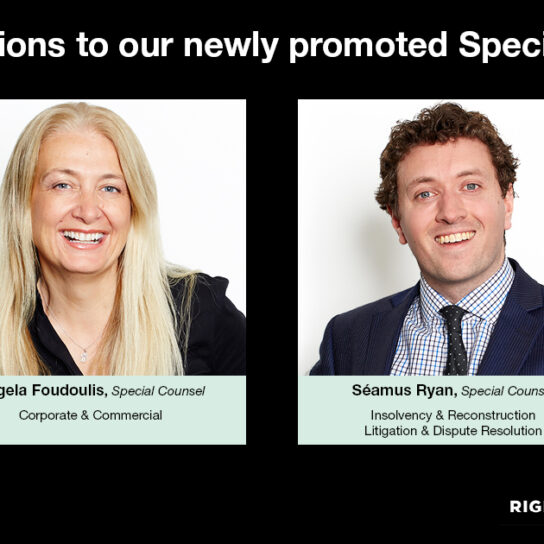

Angela Foudoulis and Séamus Ryan promoted to Special Counsel, effective 1 July 2022

Rigby Cooke Lawyers is delighted to announce the promotions of Angela Foudoulis and Séamus Ryan to Special Counsel, effective 1 July 2022.

Federal Budget 2022-23 – overview of taxation measures

On 29 March 2022, the Treasurer handed down the Federal Budget for 2022-23.

The Legal Language – Sign

Have you ever read something and thought, “I’m not sure what that means” or ‘is that really correct”? Welcome to our series of quickfire interviews that attempt to unravel those interesting words and phrases.

In this edition, we speak to Corporate & Commercial Partner and Intellectual Property practice lead Ian Rosenfeld, who talks to us about the word he finds interesting, sign.

Electronic signing here to stay – at last

- Temporary measures to allow for virtual meetings, electronic signing and distribution of corporate documents by corporations have been permanently enacted.

- Additional changes have been introduced to modernise and update the Corporations Act 2001 (Corporations Act).

Director Identification Number – changes to the regime

Under changes to the Treasury Laws Amendment (Registries Modernisation and Other Measures) Act 2020 (Cth) introduced in June 2021, all directors will be required to verify their identity as part of a new Director Identification Number (director ID) requirement.

Summary of the Commercial Tenancy Relief Scheme Regulations 2021

The Victorian government has continued the Commercial Tenancy Rent Relief Scheme Regulations 2021 (the Regulations) by enacting new regulations to account for the extended lockdown experienced by commercial tenants in Victoria.

Commercial Tenancy Relief Scheme Regulations

Further to our previous alerts (see here and here), the Victorian Government has now introduced regulations to accompany the legislation governing the Commercial Tenancy Relief Scheme (CTRS).

Commercial Tenancy Relief Scheme update

Further to our recent alert, the Victorian Government has introduced new legislation regarding the Commercial Tenancy Relief Scheme (CTRS).

New COVID relief package announced

On 28 July 2021, the Commonwealth and Victorian Governments presented new recovery packages for small businesses. The new support packages will offer $400 million in support to small businesses to be funded equally between the Commonwealth and Victorian Governments.

Misleading or deceptive claims in advertising

In a high-profile reminder that claims made in advertising need to be properly substantiated and supported by evidence, the Federal Court has ordered Lorna Jane to pay $5 million in penalties for making false and misleading representations to consumers, and engaging in conduct liable to mislead the public, in connection with its “LJ Shield Activewear”.

Amendments to the Corporations Act 2001 (Cth): Changes to director-resignation laws from 18 February 2021

To prevent illegal phoenix activity, the Commonwealth Parliament has passed the Treasury Laws Amendment (Combating Illegal Phoenixing) Act 2020 (Cth) (Act) which came into effect on 18 February 2021.

The Legal Life – meet Angela Foudoulis

Angela Foudoulis is a Senior Associate in our Corporate & Commercial group, specialising in commercial property.

Federal Budget 2020 – COVID-19 Response Package

2020 has been a challenging year for many Australians which has seen the Government forced to intervene to provide economic support and legislative provisions in an attempt to provide ongoing assistance to many Australians and businesses.

Federal Budget 2020 – Digital Business Plan

The Federal Budget 2020 saw a $795.5 million investment in the Government’s Digital Business Plan as part of the JobMaker Plan. It’s objective is to improve productivity, income growth and jobs by supporting the adoption of digital technologies by Australian businesses and to see Australia become a leading digital economy by 2030.

Commercial Landlord Hardship Fund

Following the announcement made by Treasurer Tim Pallas on 20 August 2020, the Commercial Landlord Hardship Fund (Fund) has been created in recognition of small, private landlords who may not have the capacity to provide rent reductions to their tenants under the requirements of the Commercial Tenancy Relief Scheme (CTRS).

Director penalty notices – the looming threat in the COVID-19 crisis

Since 1 April 2020, in a significant extension to the director penalty regime, company directors are now personally liable for unpaid Goods and Services Tax (GST) (including luxury car tax and wine equalisation tax). The expansion of the regime was introduced as part of the Government’s broader reform of Australia’s corporate insolvency regime.

New permanent identifier regime for directors to be introduced

On 22 June 2020, the Australian Federal Government passed legislation setting out a legal framework for the introduction of a Director Identification Number (DIN) regime for directors.

Significant reform on the horizon for Australia’s foreign investment review framework

The Government has announced proposed changes to the foreign investment review framework to take effect 1 January 2021 following the temporary measures imposed in March 2020.

Don’t forget to adjust your GST on the cancellation of contracts

Due to the widespread economic impact of COVID-19 which has caused financial uncertainty for many businesses, contracts for the acquisition of goods or services may be cancelled in order to mitigate against further losses.

The impact of COVID-19 on corporate tax residency – What is the risk?

The worldwide impact of COVID-19, which has resulted in countries around the world shutting down their borders and international travel being banned, requires companies to operate online whenever possible.

Treasurer announces changes to meeting procedures and document signing requirements

In further recognition of the difficulties faced by companies in meeting strict corporate compliance requirements in a COVID-19 environment, the Treasurer released yesterday a ministerial determination permitting company general meetings to be held virtually and modifying the way companies can execute documents.

The Legal Life – meet Ian Rosenfeld

Ian Rosenfeld is a Partner in our Corporate & Commercial team. Ian’s expertise also covers intellectual property, branding, information technology, e-commerce, commercial agreements, commercial disputes & negotiation, mergers & acquisitions, transport & logistics agreements, publishing, tenders and contracting.

Time extension for lodgement of corporate reports in impaired COVID-19 business environment

- ASIC has recently announced a one month extension for the lodgement of corporate reports

- Extension is available to unlisted entities.

Planning for AGMs as the pandemic spreads

In response to the adverse impact that the COVID-19 pandemic will have on Australian companies’ ability to hold annual general meetings (AGMs), ASIC issued a guidance note – 20-068MR on 20 March 2020 (Guidance):

How will COVID-19 impact your business contracts

The COVID-19 pandemic is having an unprecedented impact on the economy. The effects of escalating government counter-measures will change the way we do business for the foreseeable future.

What corporate veil? Company directors personally liable for unpaid GST

From 1 April 2020, in a significant extension to the director penalty regime, company directors will be personally liable for unpaid GST (including luxury car tax and wine equalisation tax).

Negotiating the Loan Term Sheet: The Borrower’s Perspective

There are new signs that the Australian property market is on the rebound. As the property market recovers, so does the credit market and companies will increasingly seek financing for their business. Financing may take many forms: revolving credit loans, loans to finance the acquisition of a target company, or construction loans, to name a few.

‘Fairness in Franchising’ – The Call for Equitable Exit Arrangements

Chapter 11 of the Parliamentary Joint Committee on Corporations and Financial Services ‘Fairness in Franchising Report’ – published in March 2019 – covered the termination of franchise agreements.

‘Fairness in Franchising’ – Unfair Contract Terms in Franchising Agreements

Last month, the Parliamentary Joint Committee on Corporations and Financial Services published its ‘Fairness in Franchising report’ (Report). The terms of reference for the Report were released over 12 months ago and more than 400 submissions were received, mostly from franchisees.

Transport & Logistics Contracts – Common but Fatal Traps

Contracts to provide transport or logistics services are vital to business success, but if not well negotiated, can have serious or even fatal consequences for the transport or logistics provider.

Tenders: high rewards but high risks

Governments and, increasingly big companies, are using tender processes (including Request for Proposals and Request for Tenders) to award contracts to transport and logistics companies.

Smart contracts – transacting in the digital era

Since the launch of Bitcoin in 2009, more and more people have become aware of blockchain technology, and its potential to revolutionise payments systems. However, blockchain has many applications beyond cryptocurrency. ‘Smart contracts’ – computer code which execute the terms of an agreement have the potential to revolutionise commercial transactions.

Parallel importing just got easier

There has been a significant amendment to the Trade Marks Act 1995 which further entrenches the legality of parallel imports in Australia.

What your organisation needs to know about mandatory data breach notifications

Mandatory data breach reporting requirements commenced on 22 February 2018. Organisations that are bound by the Privacy Act 1988 (Cth) (Privacy Act) need to report certain data breaches to the affected individual(s) and the Australian Information Commissioner.

‘Best (act) Before’ Country of Origin food labelling deadlines are enforceable

How to prepare to comply

From 1 July 2018 food businesses must comply with labelling requirements set out by the Australian Government which aim to provide consumers with greater transparency on the origin of their food.

Landmark Royce Hotel sale settles into safe hands of Melbourne hotelier and pub owner

St Kilda’s Royce Hotel has changed hands, with Melbourne pub owner Mazen Tabet and the Tabet Investment Group purchasing the freehold and business for a $55 million purchase price.

Must your personal information actually be about you? Court decision defines ‘personal’

In a recent case involving Telstra, the Full Federal Court has confirmed that personal information must be information about an individual before it will be protected and regulated by the Privacy Act and the Australian Privacy Principles.

Forgiving quarantined Div. 7A loans & UPEs

Latest news from Rigby Cooke’s tax team. Making sense of the #austax system.

Is your standard form contract fair?

Unfair contract terms provisions to be extended to small businesses on 12 November 2016.

Is your brand protected?

IP Australia fee changes looming – Renew your existing trade mark registration now to save.

IP Australia has announced a change to its fee structure. You can find out more here.

Getting the terms of trade right: lessons for traders

Many of our clients trade with customers on credit. When doing so, there is a risk that customers might be unable to pay.

Employees leaving – IT forensic accountant and confidentiality

Prudent business owners will go to great lengths to protect their intellectual property and confidential information from their employees and competitors.

To agree or not to agree

One of the golden rules when entering into an agreement is to ensure that all the terms are recorded in writing and signed by the relevant parties. As the old saying goes, a verbal agreement is as good as the paper it is written on.

Caught in the act: adultery website falls short on privacy

Ashley Madison breached a number of its obligations under Australian privacy law in the months leading up to a cyber-attack on its customer database in July 2015, a joint report by the Canadian and Australian privacy commissioners found recently.

Insights from the Victorian Manufacturers breakfast

We are pleased to have co-hosted our first Victorian Manufacturers breakfast with Klugo.

Copyright ownership for software developers – who really owns the code?

Many businesses are familiar with engaging a software developer to create a product or application, however the devil is in the detail when it comes to ownership of the end product.

Obtaining patient consent to the collection of health information

If you are a health service provider, all personal information that you collect about an individual to provide, or in providing a health service to that individual is classified as health information for the purposes of the Privacy Act.

Are you ready to report a data breach?

The effects of a privacy breach can extend beyond fines and apologies: the damage to a business’ reputation and goodwill can be costly and it may take years to rebuild.

Transferring personal information offshore – how Australian businesses can minimise the risk

Can Australian businesses send information overseas?

If your business discloses personal information to an overseas recipient, it may be accountable for any actions of the overseas recipient that would breach the APPs. This leaves your business with a significant exposure – your business could be found liable based solely on the actions of the overseas recipient.

Franchisor liable to franchisee for allowing incursions into territory

Spanline Weatherstrong Building Systems Pty Ltd, a franchisor engaged in designing, manufacturing and selling home extensions (eg patios, roof awnings, covered verandas, and carports) gave permission to one of its franchisees (Marmax Investments Pty Ltd) to conduct business within the territory of another franchisee (RPR Maintenance Pty Ltd).

CGT event time and options

In structuring 30 June transactions it is often desirable to sign a contract before 30 June, but defer payment of capital gains tax (CGT) or the CGT event until a subsequent income year; particularly where settlement is deferred to a subsequent income year so there are no sale proceeds for the vendor to pay the tax or it is desired to set-off losses in the subsequent income year.

Good faith in the franchising relationship

Key points

- Parties to a franchise agreement should always act honestly in exercising powers and performing obligations under the agreement and the Franchising Code of Conduct

Pharmacy Location Rules considered by the Full Federal Court

On 3 February 2016 the Full Federal Court handed down its decision in Assarapin v. Australian Community Pharmacy Authority. 1

Do your deeds of indemnity for officers and directors require review?

- A recent court decision highlights the need for companies to review deeds of indemnity given to the company’s directors

- The decision illustrates the importance for officers and employees of having effective and extensive directors and officers insurance from the outset

What is the European Court of Justice Safe Harbour ruling?

The European Court of Justice has ruled that a 15-year-old agreement allowing companies to transfer personal information from servers within the European Union to servers in the United States is invalid.