Rigby Cooke Lawyers is delighted to welcome Steven Apostolou as the Lead Partner of our Property practice, commencing on 1 July 2025.

Category: Property

Our latest news and insights

A collection of articles, case studies and media releases highlighting the latest in legal news and at Rigby Cooke Lawyers.

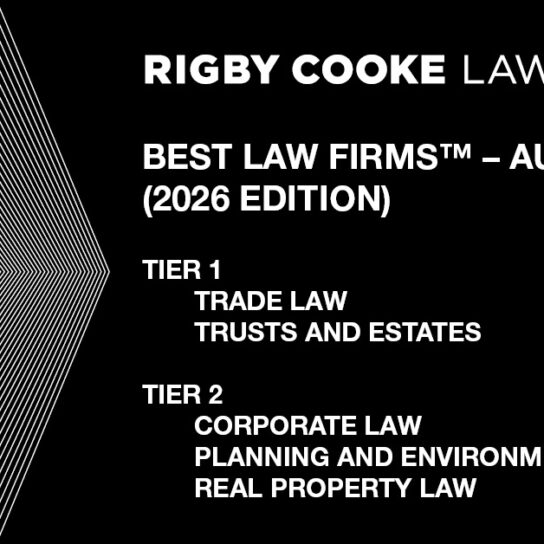

Rigby Cooke Lawyers recognised in Best Law Firms™ – Australia (2026 Edition)

Rigby Cooke Lawyers is delighted to share that we have been recognised among the best law firms in Melbourne for five areas of law in the second edition of Best Law Firms™ – Australia.

Victorian State Budget 2025-26 — Revenue measures explained

On 20 May 2025, Treasurer Jaclyn Symes handed down the Victorian State Budget 2025-26. While no new taxes have been announced, there is no relief in sight for landowners in respect of the various taxes currently in place. These include transfer duty, land tax, vacant residential land tax, foreign purchaser additional duty, absentee owner surcharge, and windfall gains tax.

Six Rigby Cooke Lawyers’ partners named in 2026 edition of The Best Lawyers in Australia™

Rigby Cooke Lawyers is delighted to share that six of our esteemed partners have been recognised across eight areas of law in the 2026 edition of The Best Lawyers in Australia™.

Introducing Mark Gomez, Associate in our Property group

We are delighted to introduce Mark Gomez, Associate in our Property group.

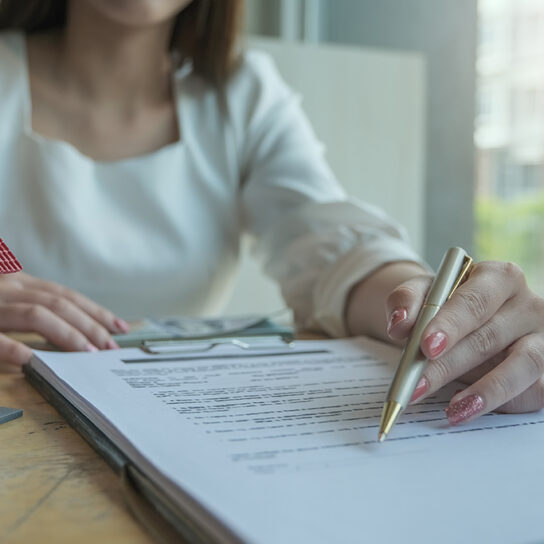

Lease incentives and clawback provisions

Lease incentives offered by landlords to tenants have significantly evolved in recent times. Since the onset of COVID-19, there has been a substantial decline in commercial tenancies for various reasons, leading to an increased need for landlords to lure and entice tenants into signing new leases or renewing for additional terms.

In our latest Property alert, we explain what a lease incentive is, the purpose of the clawback clause, and the implications for both landlord and tenants when negotiating a lease.

What you need to know about the windfall gains tax

The windfall gains tax (WGT) is a new tax that is imposed on the increase in value of property in Victoria as a result of a rezoning of that land.

Rigby Cooke Lawyers recognised in Best Law Firms™ – Australia

We are pleased to share the news that five of our practice areas, including Corporate & Commercial, Customs & Trade, Planning & Environment, Property and Wills, Trusts & Estates, have been recognised by Best Lawyers in their inaugural edition of Best Law Firms™ – Australia.

The Commercial and Industrial Property Tax is now law

On 21 May 2024, the Commercial and Industrial Property Tax Reform Act 2024 received Royal Assent, officially making the Commercial and Industrial Property Tax (CIPT) law. The new CIPT regime will apply to eligible transactions from 1 July 2024.

Vacant residential land tax — Extension of holiday home exemption

On 14 May 2024, the Victorian Government introduced the State Taxation Amendment Bill 2024 (Bill) into Parliament. The Bill (if passed) amends the Land Tax Act 2005 to expand the exemption from the vacant residential land tax (VRLT) for holiday homes.

Rigby Cooke Lawyers’ Bill Karvela recommended for property law in the 2024 Doyle’s Guide

We are delighted to share the news that Bill Karvela, Managing Partner, and our Property practice have been recognised for their expertise within the areas of transactional property and real estate matters in the Doyle’s Property Guides for Victoria.

The Commercial and Industrial Property Tax — Details of the new measures

On 20 March 2024, the Commercial and Industrial Property Tax Reform Bill 2024 (Bill) was introduced into Victorian Parliament.

Rigby Cooke Lawyers assists DSV Air & Sea in long-term lease at Port of Brisbane

Rigby Cooke Lawyers assisted DSV Air & Sea on its 10-year lease agreement with Port of Brisbane Pty Ltd (PBPL) for a warehouse and container hardstand on a 4.8ha site on Fisherman Islands, which was announced recently.

Rigby Cooke Lawyers’ partners named in the 17th edition of The Best Lawyers in Australia™

We are pleased to announce that five of our esteemed partners have been recognised in the 17th edition of The Best Lawyers in Australia™.

The Commercial and Industrial Property Tax — Overview of reforms from 1 July 2024

In the 2023-24 State Budget, the Victorian Government announced a reform to move away from stamp duty for qualifying commercial and industrial properties, to be replaced by the new annual Commercial and Industrial Property Tax (CIPT).

Significant Victorian property tax changes from 1 January 2024

On 12 December 2023, the State Taxation Acts and Other Acts Amendment Act 2023 (the Act) received Royal Assent.

In our latest Property Tax alert, we look at the major changes introduced by the Act to Victorian property taxes, including prohibiting the apportionment of land tax and windfall gains tax in contracts for the sale of real estate.

Understanding the tricks and traps to leasing a transport storage facility

Transport and logistics are the backbone of Australia’s economy, with the need for secure and efficient storage facilities increasing steadily. Whether you are a seasoned logistics professional or a newcomer to the industry, leasing a transport storage facility in Australia can be a complex process. This article serves as a guide to help you navigate the intricacies of leasing a transport storage facility.

Supreme Court confirms vendors’ obligations to notify of works affecting the natural surface level for off-the-plan land sales

A recent decision by the Supreme Court of Victoria has confirmed the ongoing obligation for vendors to notify purchasers of works affecting the natural surface level of the land when selling land off-the-plan.

Victorian decision signals increased risk of landholder duty in capital raisings

A recent Victorian Civil and Administrative Tribunal (VCAT) decision has raised red flags for property developers who undertake capital raisings. The decision increases the risk that as a result of such raisings, equity interests acquired by unrelated investors in development entities may be aggregated under the landholder regime. This aggregation of interests may trigger a significant stamp duty liability, for which the developer and investors will be jointly liable.

Rigby Cooke Lawyers promotes Tom Hoerner to Special Counsel, and James Anglicas and Biljana Stankovski to Associate, effective 1 July 2023

Rigby Cooke Lawyers is delighted to announce the promotions of Tom Hoerner (Litigation & Dispute Resolution) to Special Counsel, and James Anglicas (Litigation & Dispute Resolution) and Biljana Stankovski (Property) to Associate, effective 1 July 2023.

Victorian Budget 2023-24 – Overview of significant measures

On 23 May 2023, the Victorian Government delivered the State Budget.

Detailed below is a summary of the significant tax measures and a consideration of the announced measures in greater detail.

Six partners from Rigby Cooke Lawyers named in the 16th edition of The Best Lawyers in Australia™

Rigby Cooke Lawyers is pleased to announce that six of our esteemed partners across six practice areas have been recognised in the 16th edition of The Best Lawyers in Australia™.

Rigby Cooke Lawyers advises hotel investor in acquisition of the Lyall Hotel and Spa

Rigby Cooke Lawyers’ Corporate & Commercial group advised hotel investor and developer, Mazen Tabet and the Tabet Group, in the successful acquisition of the Lyall Hotel and Spa in South Yarra.

Federal Budget 2022-23 — New tax measures announced

On 25 October 2022, Federal Treasurer Jim Chalmers handed down the Budget of the newly elected Government for 2022-23.

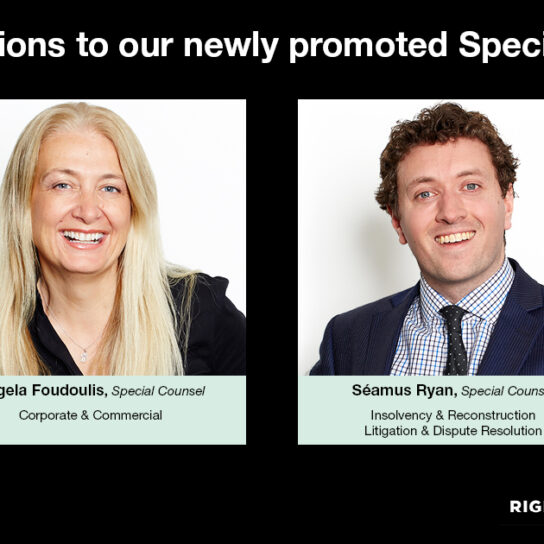

Angela Foudoulis and Séamus Ryan promoted to Special Counsel, effective 1 July 2022

Rigby Cooke Lawyers is delighted to announce the promotions of Angela Foudoulis and Séamus Ryan to Special Counsel, effective 1 July 2022.

The Legal Language – off-the-plan

Have you ever read something and thought, “I’m not sure what that means” or ‘is that really correct”? Welcome to our series of quickfire interviews that attempt to unravel those interesting words and phrases.

In this edition, we speak to Property Lawyer Biljana Stankovski, who talks to us about the phrase she finds interesting, off-the-plan.

The Legal Language – Caveat emptor

Have you ever read something and thought, “I’m not sure what that means” or ‘is that really correct”? Welcome to our series of quickfire interviews that attempt to unravel those interesting words and phrases.

In this edition, we speak to Property Partner Tim Kelly, who talks to us about the phrase he finds interesting, Caveat emptor.

Commercial Tenancy Relief Scheme 2022

Further to our previous alerts, the Commercial Tenancy Relief Scheme is now extended to cover the period from 16 January 2022 to 15 March 2022.

Windfall Gains Tax is now law

The Windfall Gains Tax and State Taxation and Other Acts Further Amendment Act 2021 (the Act) received Royal Assent on 30 November 2021.

The Windfall Gains Tax is on the way

During the 2021 Victorian State Budget, the Government announced that it would introduce a ‘windfall gains tax’ (WGT) that would apply to large windfall gains associated with planning decisions to rezone land.

Summary of the Commercial Tenancy Relief Scheme Regulations 2021

The Victorian government has continued the Commercial Tenancy Rent Relief Scheme Regulations 2021 (the Regulations) by enacting new regulations to account for the extended lockdown experienced by commercial tenants in Victoria.

Commercial Tenancy Relief Scheme Regulations

Further to our previous alerts (see here and here), the Victorian Government has now introduced regulations to accompany the legislation governing the Commercial Tenancy Relief Scheme (CTRS).

The Legal Life – meet Biljana Stankovski

Biljana Stankovski is a Lawyer in our Property team.

Biljana shares her goals for the remainder of 2021 and her favourite holiday spot.

Commercial Tenancy Relief Scheme update

Further to our recent alert, the Victorian Government has introduced new legislation regarding the Commercial Tenancy Relief Scheme (CTRS).

New COVID relief package announced

On 28 July 2021, the Commonwealth and Victorian Governments presented new recovery packages for small businesses. The new support packages will offer $400 million in support to small businesses to be funded equally between the Commonwealth and Victorian Governments.

Victorian Budget 2021-22: Property-related announcements legislated

The various Property-related tax measures announced in the Victorian State Government Budget will now become law.

The State Taxation and Mental Health Acts Amendment Bill 2021 (the Bill) has passed Victorian Parliament and is currently awaiting Royal Assent.

Victorian Budget 2021-22: overview of Property measures

The Victorian State Government Budget, released on Thursday 20 May 2021, has produced a mixed bag of tax amendments that will affect many taxpayers who own property or are involved in property development.

Recent amendment to the Land Tax Act to abolish ‘special land tax’

A recent amendment to the Land Tax Act has abolished “special land tax”. Special land tax was a one off tax charge at the rate of 5% of the unimproved value of the land. The abolition of the tax came into effect from the 16 December 2020.

The Legal Life – meet Angela Foudoulis

Angela Foudoulis is a Senior Associate in our Corporate & Commercial group, specialising in commercial property.

Commercial Landlord Hardship Fund

Following the announcement made by Treasurer Tim Pallas on 20 August 2020, the Commercial Landlord Hardship Fund (Fund) has been created in recognition of small, private landlords who may not have the capacity to provide rent reductions to their tenants under the requirements of the Commercial Tenancy Relief Scheme (CTRS).

Updates to rental lease rights and obligations during COVID-19

Today, Treasurer Tim Pallas announced that the Victorian Government will extend its moratorium on evictions and rental increases for both residential and commercial tenancies in Victoria until 31 December 2020. There will be some specific exceptions to this rule, the details of which are yet to be identified.

Victorian Land Tax discount and deferral relief to eligible property owners

The Victorian Government recently announced a range of tax relief measures in response to COVID-19 to assist landlords and businesses. The State Revenue Office (SRO) has now provided further guidance on these initiatives.

COVID-19 Omnibus Regulations 2020 – the uncertainty continues

On 1 May 2020 the Victorian Government passed regulations for the COVID-19 Omnibus (Emergency Measures) (Commercial Leases and Licences) Regulations 2020 (the Regulations) giving substance to the National Cabinet Mandatory Code of Conduct (the Code).

National Code of Conduct: Know your rights and obligations during COVID-19

Following on from our previous article regarding leasing rights and obligations during the current COVID-19 pandemic (COVID-19), there have been further developments announced by the Federal Government. If you are after a definitive answer, we’re not quite there yet, but we are getting closer. Code

The Legal Life – meet Michael Gough

Meet Michael Gough, a Partner in our Property group with over 25 years of experience in commercial and residential property development. Michael has significant expertise in hotel acquisition, development and management agreements, transport infrastructure projects, structuring of significant property transactions and advising on property related taxation issues, property financing, planning and land use advice, and regulatory consents and approvals (including FIRB approvals).

Landlords, take advantage of COVID-19 insolvency legislative reform: now is the time to register security interests in cash security deposits on the PPSR

- Landlords should register security interests on the PPSR in cash security deposits or cash bonds paid under a commercial or retail leases

Know your lease rights and obligations

The current COVID-19 situation brings uncertain and unsettling times.

Rigby Cooke has received several enquiries from landlords and tenants alike regarding their rights and obligations under their lease.

Short-stay accommodation is not just in Victoria for a short stay

Although short-stay accommodation is not a new concept, the introduction of AirBnB (also known as ‘AirBed and Breakfast’) and similar short term letting agencies created a worldwide phenomenon resulting in an upsurge in short-stay rentals.

Your discretionary trust will be deemed a ‘foreign trust’ from 1 March 2020

Are you considering purchasing Victorian property through a discretionary trust? Think again, because from 1 March 2020 the State Revenue Office (SRO) will deem all discretionary trusts to constitute foreign purchasers.

Stop tax in its tracks – ATO extends CGT exemption on sale of deceased’s residence

The sale of a person’s main residence (ie their home) is generally exempt from capital gains tax. This exemption is ‘carried through’ to beneficiaries or executors of deceased estates who seek to dispose of the deceased’s main residence, where certain conditions are satisfied.

Are you overpaying land tax?

Are you overpaying land tax based on out of date council valuations?

The 2019-2020 Victorian State Budget reported that land tax revenue in 2019-2020 is expected to increase to $3.7 billion. This is a significant increase from the $1.2 billion raised in 2009-2010.

Duties Trap for Property Developers – Economic entitlement rules now law

Property developers who enter into agreements to develop Victorian land with an unencumbered value of over $1 million are at significant risk of incurring a duty liability, under new legislation that received Royal Assent on 18 June 2019.

Rigby Cooke Lawyer recently acted for Stronghold Investment Management on its acquisition of the Cardinia Club

Rigby Cooke Lawyer, led by property partner Darren Marx, recently acted for Stronghold Investment Management on its acquisition of the Cardinia Club from Pakenham Racing Club for $16m. The well established entertainment venue has 105 Electronic Gaming Machines, a large bistro, upmarket sports bar and multiple function rooms. Brisbane based Stronghold is a specialist Business Park and Hospitality sector Fund Manager.

Important changes to the Real Estate Industry Award – is your agency compliant?

On 2 April 2018 significant changes to the Real Estate Industry Award 2010 (Real Estate Award) made by the Fair Work Commission (FWC) came into effect.

GST withholding changes introduced to combat phoenixing practices in property development

New laws have been passed affecting the GST obligations of property developers. These laws take effect from 1 July 2018, but may affect contracts entered into prior to this date.

Landmark Royce Hotel sale settles into safe hands of Melbourne hotelier and pub owner

St Kilda’s Royce Hotel has changed hands, with Melbourne pub owner Mazen Tabet and the Tabet Investment Group purchasing the freehold and business for a $55 million purchase price.

Update – Residential Tenancies Act Reform

The Residential Tenancies Act 1997 (Act) is currently undergoing a significant review as part of the Victorian Government’s extensive Fairer Safer Housing initiative. The proposed amendments contained within the review will have an impact on both caravan and residential park residents and operators.

A win for regional Victoria: Increase to First Home Owner Grant on its way

The Victorian Government announced that it intends to increase the First Home Owner Grant (FHOG) from $10,000 to $20,000 for new homes built in regional Victoria and valued up to $750,000.

Can you on-sell your off-the-plan purchase before your own settlement?

NSW case challenges contract restrictions.

In a recent New South Wales case of Fuentes v Bondi Beachside Pty Ltd, Fuentes purchased a unit ‘off the plan’.

Retail Leases Act – Reminder expiry clauses

This is a timely reminder for both landlords and tenants of retail leases that pursuant to the legislation (Retail Leases Act 2003 Vic),

To agree or not to agree

One of the golden rules when entering into an agreement is to ensure that all the terms are recorded in writing and signed by the relevant parties. As the old saying goes, a verbal agreement is as good as the paper it is written on.

Partitioning land and bare trusts

Co-owners of land or parcels of land often wish to exchange ownership interests to become sole owners of specific land or specific parcels of land.

Foreign property transactions to be hit with additional expenses

A number of recent changes affecting foreign purchasers of property in Victoria have either come into, or are soon to come into effect. These changes are already impacting on the sale of property.

Good stamp duty news for foreign hotel buyers

As you may be aware, there is a Bill (State Taxation and Other Acts Amendment Bill 2016) before the Victorian Parliament that will upon becoming law, have the effect of increasing the stamp duty surcharge on the acquisition by foreign purchasers of residential property in Victoria to 7%.

New foreign resident capital gains withholding payments regime

Quick facts:

- From 1 July 2016, any purchaser who acquires an Australian property with value of $2 million or more from a foreign resident vendor will be required to withhold and pay 10% of the purchase price to the Australian Taxation Office (ATO).

PROPERTY ALERT >> Buyer Beware of Cooling Off Rights

If you are considering buying a property, it’s important to be aware of the correct procedures for cancelling the contract if that should become necessary. A new Supreme Court ruling that saw a purchaser forfeit their deposit and pay damages sets a new precedent that all agents and buyers should follow.

CGT event time and options

In structuring 30 June transactions it is often desirable to sign a contract before 30 June, but defer payment of capital gains tax (CGT) or the CGT event until a subsequent income year; particularly where settlement is deferred to a subsequent income year so there are no sale proceeds for the vendor to pay the tax or it is desired to set-off losses in the subsequent income year.