Category: COVID-19

Our latest news and insights

A collection of articles, case studies and media releases highlighting the latest in legal news and at Rigby Cooke Lawyers.

Federal Budget 2022-23 — New tax measures announced

On 25 October 2022, Federal Treasurer Jim Chalmers handed down the Budget of the newly elected Government for 2022-23.

COVID-19 isolation rules scrapped – here’s what employers need to know

On 30 September 2022, the Prime Minister announced that National Cabinet agreed that from Friday 14 October 2022 there will no longer be a mandatory isolation period for COVID-19. Premier Daniel Andrews has announced that Victoria’s pandemic declaration will come to an end at 11.59pm on Wednesday 12 October, so mandatory isolation will end one day earlier in Victoria.

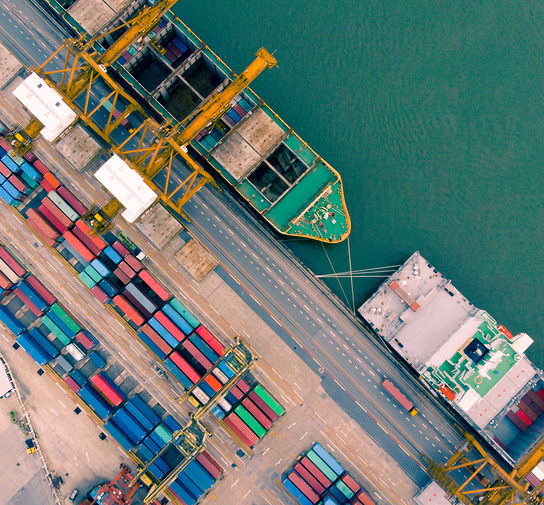

Federal Budget 2022-23 – overview of customs and trade related measures

On 29 March 2022, the Treasurer handed down the Australian Federal Budget for 2022-23 (Budget).

Federal Budget 2022-23 – overview of taxation measures

On 29 March 2022, the Treasurer handed down the Federal Budget for 2022-23.

Extension of Victorian Mandatory Vaccination requirements and booster shot requirements

The Victorian Government has again extended Mandatory Vaccination requirements for workers and operators of specified facilities from 11.59pm 12 January 2022 under the Pandemic Orders1.

Victorian Mandatory Vaccination requirements extended under Pandemic Orders

The Victorian Government has now extended Mandatory Vaccination requirements for workers until 12 January 2022 under the new suite of Pandemic Orders1.

Changes to Victoria’s Mandatory Vaccination exemption requirements

Under the new COVID-19 Mandatory Vaccination (Workers) Directions (Directions) issued on 18 November, workers are now required to provide a current COVID-19 digital certificate as ‘acceptable certification’ to prove an exemption from the Mandatory Vaccination requirements (Vaccination Requirements).

New proof of COVID-19 vaccination medical exemption requirements in Victoria

Effective from 6pm on Friday 12 November 2021, Victorian employers must sight more than a medical certificate to establish that a worker is exempt from the mandatory vaccination requirements (Vaccination Requirements).

Mandatory Vaccination Directions for Victorian workers released

Following an announcement by the Premier on Friday 1 October, the Victorian Acting Chief Health Officer has now issued Mandatory Vaccination Directions (Directions) that apply to select workers1 (previously referred to as authorised workers) except those in specific industry groups of healthcare, aged care, construction and education.

Vaccination status and the Privacy Act

- Businesses must remember their privacy obligations when collecting vaccination status information (and other sensitive information) about employees, contractors and other visitors to the workplace.

- Unless collection is required or authorised by law, informed consent is generally required for the collection of sensitive information.

- Businesses must provide a Collection Notice to all individuals, including employees, even if consent to collection is not required.

- Only the minimum amount of personal information reasonably necessary to prevent or manage COVID-19 or required by law should be collected, used or disclosed.

Mandatory Vaccinations for all Victorian authorised workers

On Friday 1 October, the Victorian Premier announced new rules in relation to vaccination requirements for workers attending workplaces.

Summary of the Commercial Tenancy Relief Scheme Regulations 2021

The Victorian government has continued the Commercial Tenancy Rent Relief Scheme Regulations 2021 (the Regulations) by enacting new regulations to account for the extended lockdown experienced by commercial tenants in Victoria.

Commercial Tenancy Relief Scheme Regulations

Further to our previous alerts (see here and here), the Victorian Government has now introduced regulations to accompany the legislation governing the Commercial Tenancy Relief Scheme (CTRS).

Commercial Tenancy Relief Scheme update

Further to our recent alert, the Victorian Government has introduced new legislation regarding the Commercial Tenancy Relief Scheme (CTRS).

New COVID relief package announced

On 28 July 2021, the Commonwealth and Victorian Governments presented new recovery packages for small businesses. The new support packages will offer $400 million in support to small businesses to be funded equally between the Commonwealth and Victorian Governments.

Misleading or deceptive claims in advertising

In a high-profile reminder that claims made in advertising need to be properly substantiated and supported by evidence, the Federal Court has ordered Lorna Jane to pay $5 million in penalties for making false and misleading representations to consumers, and engaging in conduct liable to mislead the public, in connection with its “LJ Shield Activewear”.

HR Hot Tip – Flexible working arrangements. Who can request them?

Welcome to our series of HR interviews with Associate Stephanie Shahine, who answers some of the most common questions asked by HR managers regarding employees’ legal entitlements and employers’ health and safety requirements, especially as business begins to transition back into the office.

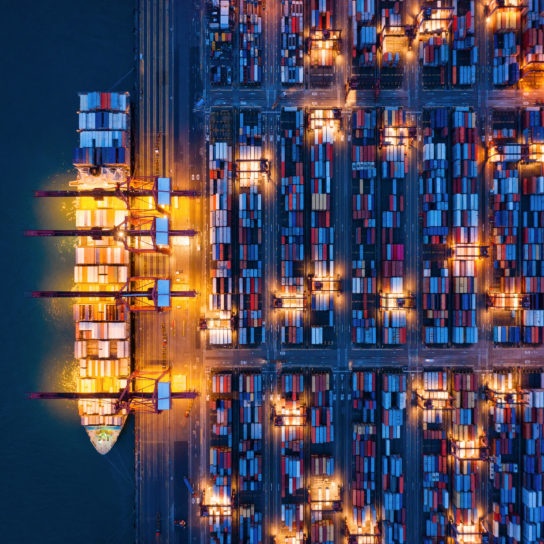

The ongoing Australian trade agenda response to the COVID–19 pandemic. Open for business even with borders closed

This article was first published in June 2021 by Thomson Reuters Canada.

Despite the optimism surfacing in some quarters that the world and its economy are recovering from the COVID-19 Pandemic, recovery is far from complete and the consequences will continue to affect the world for many years. This article provides some insight into how Australia’s trade has coped and the shape of its recovery – with a little help from its friends.

HR Hot Tip – Is the employer obliged to set up office equipment at home as well as at the office?

Welcome to our series of HR interviews with Associate Stephanie Shahine, who answers some of the most common questions asked by HR managers regarding employees’ legal entitlements and employers’ health and safety requirements, especially as business begins to transition back into the office.

HR Hot Tip – Face masks and Personal Protective Equipment: as an employer, am I required to provide face masks to employees?

Welcome to our series of HR interviews with Associate Stephanie Shahine who answers some of the most common questions asked by HR managers regarding employees’ legal entitlements and employers’ Health and Safety requirements, especially as business begins to transition back into the office.

No vaccination jab, no job?

The Fair Work Commission (FWC) has recently handed down two significant decisions which turn to the question of whether requiring an employee to receive an influenza vaccination is a lawful and reasonable direction.

HR Hot Tip – Safe workplaces: COVID-19 tests and staff quarantine

Welcome to our series of HR interviews with Associate Stephanie Shahine, who answers some of the most common questions asked by HR managers regarding employees’ legal entitlements and employers’ health and safety requirements, especially as business begins to transition back into the office.

HR Hot Tip – Can a business direct staff to return to work?

Welcome to our series of HR interviews with Associate Stephanie Shahine, who answers some of the most common questions asked by HR managers regarding employees’ legal entitlements and employers’ health and safety requirements, especially as business begins to transition back into the office.

Beyond the pandemic – trade facilitation and supply chain questions

This article was first published in April 2021 by Daily Cargo News.

The world continues to struggle with the practical consequences of congestion in the supply chain and governments are initiating reviews into supply chain vulnerabilities and how they may be addressed. However, it remains important that we do not overlook other initiatives to facilitate trade which may have been stalled by the focus on the more immediate problems of the global pandemic.

Managing contract risk in a COVID-19 climate

This article was first published in March 2021 by AMTIL.

With the commercial impacts of COVID-19 still fully to reveal themselves, the uncertainty this creates for manufacturers, suppliers and service providers in the construction, engineering and infrastructure sectors will likely be felt for some time.

Return to work, return to manufacturing – Managing COVID-19 Risks

This article was first published on 10 December 2020 by AMTIL.

As COVID-19 (COVID) community transmission rates continue to stay at zero, Victorians welcome back normality. Or something close to it. Since 11:59 pm, 8 November, metropolitan Melbourne entered the third stage of reopening, in line with regional Victoria.

Federal Budget 2020 – COVID-19 Response Package

2020 has been a challenging year for many Australians which has seen the Government forced to intervene to provide economic support and legislative provisions in an attempt to provide ongoing assistance to many Australians and businesses.

Federal Budget 2020 – some customs and trade issues

On Tuesday 6 October 2020, the Federal Government released its proposed budget for 2020-21, together with forward estimates of future receipts and expenses. As usual, most of the details had previously been formally announced or “leaked” previously but it is worth paying attention to a few issues. In doing so I have borrowed shamelessly from the exact words from the relevant budget text to ensure accuracy and only added additional commentary when the issue warrants that additional attention.

Federal Budget 2020 – overview of taxation measures announced

The Treasurer handed down the Federal Budget 2020-21 on 6 October 2020. Detailed below is an overview of the significant tax measures announced, followed by further information regarding each of these measures.

VCLGR announces Temporary Limited Licenses for hospitality industry

The pandemic period has been an extreme burden on the hospitality industry. The Victorian Commission for Gambling and Liquor Regulation (VCGLR) in conjunction with the Victorian Government has, in addition to its previous leniency on certain liquor regulations, agreed to support licensees with the opportunity to extend their trading footprint by seeking a temporary licence to trade outdoors for the duration of the COVID-19 period.

Facilitating and regulating e–commerce

This article was first published in September 2020 by Daily Cargo News.

One of the stories from the COVID–19 pandemic has been the surging numbers of goods being moved through e-commerce. The forced levels of isolation have caused consumers and corporates to resort to purchasing even more goods than ever online seeking urgent delivery.

Large fine for Fatigue Breaches under Heavy Vehicle National Law

During these difficult times, it is important that all members of the supply chain remember their obligations under the Heavy Vehicle National Law (HVNL) and, in particular, their primary duty under the Chain of Responsibility (CoR) provisions. The potential financial and legal ramifications of failing to comply with those obligations can be significant as seen in a recent case in Queensland.

JobKeeper 2.0 – extension bill passes Parliament

Late yesterday, the Coronavirus Economic Response Package (JobKeeper Payments) Amendments Bill 2020 (Bill) to extend the JobKeeper Payment scheme (JobKeeper) announced by the Federal Government in July 2020 was passed by Parliament after Labor and the Greens failed to win support for amendments.

Comment: the Commonwealth moves to rein in agreements with foreign governments

This article was first published in August 2020 by Daily Cargo News.

The Australian Commonwealth Constitution (the Commonwealth) has an interesting history including its development through a series of Constitutional Conventions between the representative of state governments and other interested parties.

Commercial Landlord Hardship Fund

Following the announcement made by Treasurer Tim Pallas on 20 August 2020, the Commercial Landlord Hardship Fund (Fund) has been created in recognition of small, private landlords who may not have the capacity to provide rent reductions to their tenants under the requirements of the Commercial Tenancy Relief Scheme (CTRS).

Updates to rental lease rights and obligations during COVID-19

Today, Treasurer Tim Pallas announced that the Victorian Government will extend its moratorium on evictions and rental increases for both residential and commercial tenancies in Victoria until 31 December 2020. There will be some specific exceptions to this rule, the details of which are yet to be identified.

Licence to move freight

This article was first published in August 2020 by The Daily Cargo News.

In many countries, some participants in the private supply chain are licensed by government to undertake their roles.

Changes to support and control of medical treatment equipment at the border increase with COVID-19

This article was first published in August 2020 by AMT Magazine.

During the current pandemic, the focus of many has been on the manufacture of medical equipment required for the treatment of COVID-19 and their urgent movement through the international supply chain.

New duty to report COVID-19 to WorkSafe

Consistent with the ever-changing workplace during this COVID-19 Pandemic, another new requirement has been introduced for employers.

Director penalty notices – the looming threat in the COVID-19 crisis

Since 1 April 2020, in a significant extension to the director penalty regime, company directors are now personally liable for unpaid Goods and Services Tax (GST) (including luxury car tax and wine equalisation tax). The expansion of the regime was introduced as part of the Government’s broader reform of Australia’s corporate insolvency regime.

Paid pandemic leave for aged care workers?

The Fair Work Commission (FWC) has today (Wednesday 22 July 2020) issued a statement that it has come to a provisional view that paid pandemic leave should be inserted into the Aged Care Award.

Victoria announces independent review of the operation of Victoria’s Ports

As an island nation, Australia has always relied heavily on its ports, their wharves and other facilities as well as the associated land–side infrastructure including rail and road access, stevedore operations and empty container parks. Much of the national and international supply chain relies on the efficient operation of the sector.

New Indonesian Free Trade deal up and running

This article was first published in July 2020 by The Daily Cargo News.

The Indonesia–Australia Comprehensive Economic Partnership Agreement is a positive development for the global free trade agenda writes Customs and Trade Partner, Andrew Hudson.

Significant reform on the horizon for Australia’s foreign investment review framework

The Government has announced proposed changes to the foreign investment review framework to take effect 1 January 2021 following the temporary measures imposed in March 2020.

The Australian trade response to the COVID-19 Pandemic and issues into the future

This article was first published in June 2020 by Thompson Reuters.

One of the fundamental roles of governments during the COVID–19 Pandemic has been to assist the movement of goods through the international and domestic supply chain as well as to support those providing services in that supply chain. While there has been an understandable focus on movement of Personal Protective Equipment (PPE) and related equipment and medication needed to assist in treatment of those affected by the Pandemic, that focus has not excluded the adoption of measures to assist trade in other goods adversely affected by the significant reduction in air and sea cargo options.

Don’t forget to adjust your GST on the cancellation of contracts

Due to the widespread economic impact of COVID-19 which has caused financial uncertainty for many businesses, contracts for the acquisition of goods or services may be cancelled in order to mitigate against further losses.

JobKeeper – Remember to claim for your eligible business participant

The JobKeeper payment scheme was announced on 30 March 2020 with the objective of providing financial support to entities to assist with the impact of COVID-19. Since that time, there has been a significant amount of information released to explain the complex operation of the scheme, including Treasury Rules, Australian Tax Office (ATO) rulings and guidelines, together with amendments to the Fair Work Act 2009 to enable employers to temporarily vary work arrangements for eligible employees.

Significant decisions re stand down and JobKeeper

In a busy week for the courts and the Fair Work Commission (FWC), three significant decisions have been handed down related to COVID-19 issues. Brief summaries are set out below:

Important changes in the Transport & Logistics industry

There have been a number of developments in recent weeks that all transport and logistics operators with employees need to be aware of.

Video Witnessing in 2020 – Wills and Enduring Powers of Attorney

Recently we discussed how the COVID-19 pandemic has brought to the forefront the importance of having a Will and Powers of Attorney in place. It has also highlighted the challenges of arranging and executing these documents whilst in lockdown.

The impact of COVID-19 on corporate tax residency – What is the risk?

The worldwide impact of COVID-19, which has resulted in countries around the world shutting down their borders and international travel being banned, requires companies to operate online whenever possible.

New Indonesian Free Trade deal to be a bright spot in our trade agenda

One of the major tasks for government’s around the world are to adopt measures which may assist business to recover and thrive as they plan to move out of COVID– 9 restrictions. As much as national governments have committed to generally keep borders open, there remains the need to actively take action to ensure that commitments are met and that new initiatives are adopted to support further enhancements to the trade environment.

Treasurer announces changes to meeting procedures and document signing requirements

In further recognition of the difficulties faced by companies in meeting strict corporate compliance requirements in a COVID-19 environment, the Treasurer released yesterday a ministerial determination permitting company general meetings to be held virtually and modifying the way companies can execute documents.

Victorian Land Tax discount and deferral relief to eligible property owners

The Victorian Government recently announced a range of tax relief measures in response to COVID-19 to assist landlords and businesses. The State Revenue Office (SRO) has now provided further guidance on these initiatives.

COVID-19 Omnibus Regulations 2020 – the uncertainty continues

On 1 May 2020 the Victorian Government passed regulations for the COVID-19 Omnibus (Emergency Measures) (Commercial Leases and Licences) Regulations 2020 (the Regulations) giving substance to the National Cabinet Mandatory Code of Conduct (the Code).

ABF releases details on exemption from customs duty for medical equipment

During the current pandemic, the focus of many has been on the manufacture of the medical equipment required for the treatment of COVID -19 and their urgent movement through the international supply chain.

COVID-19 & JobKeeper updates – Latest Legislative and Award Changes

On 8 April 2020, the Parliament passed legislation to give effect to the Government’s JobKeeper scheme and to amend the Fair Work Act 2009 (Cth) (FW Act) to give eligible employers greater flexibility to modify employees’ working hours, days, duties and location to minimise the impact of the COVID-19 pandemic on their business and seek to preserve jobs.

Time extension for lodgement of corporate reports in impaired COVID-19 business environment

- ASIC has recently announced a one month extension for the lodgement of corporate reports

- Extension is available to unlisted entities.

National Code of Conduct: Know your rights and obligations during COVID-19

Following on from our previous article regarding leasing rights and obligations during the current COVID-19 pandemic (COVID-19), there have been further developments announced by the Federal Government. If you are after a definitive answer, we’re not quite there yet, but we are getting closer. Code

Landlords, take advantage of COVID-19 insolvency legislative reform: now is the time to register security interests in cash security deposits on the PPSR

- Landlords should register security interests on the PPSR in cash security deposits or cash bonds paid under a commercial or retail leases

COVID-19 & JobKeeper – Latest Legislative and Award Changes

Last night, the Parliament passed legislation to give effect to the Government’s JobKeeper scheme and to amend the Fair Work Act 2009 (Cth) (FW Act) to give eligible employers greater flexibility to modify employees’ working hours, days, duties and location to minimise the impact of the COVID-19 pandemic on their business and seek to preserve jobs. The legislation became law after receiving Royal Assent today.

Coronavirus (COVID-19) FAQ’s for Employers

Current as at 1.00pm 9 April 2020

The Coronavirus (COVID-19) pandemic has raised a number of questions for employers. It is important to stay abreast of government regulation in this area as it will impact the decisions you make as a business and the currency and relevancy of our comments below.

ATO offers some flexibility under the Superannuation Guarantee Amnesty due to impact of COVID-19

Many employers seeking to take corrective action under the Superannuation Guarantee Amnesty (the Amnesty) may currently be so overwhelmed by the impacts of the COVID-19 pandemic that they do not consider they have the financial resources to apply for the Amnesty.

Planning for AGMs as the pandemic spreads

In response to the adverse impact that the COVID-19 pandemic will have on Australian companies’ ability to hold annual general meetings (AGMs), ASIC issued a guidance note – 20-068MR on 20 March 2020 (Guidance):

Fair Work Commission’s response to the COVID-19 pandemic

The COVID-19 pandemic and the restrictions implemented by both Federal and State Governments to combat the pandemic have had a substantial impact on businesses and their employees.

Australian Government support for Australian seafood exporters and other COVID-19 developments

On 1 April 2020, the Australian Federal Government announced a new financial package to support exports of seafood to overseas markets as well as to increase funding of the Export Market Development Grant scheme (EMDG). This is one of a series of financial support packages released as part of Australia’s response to the effects of the COVID-19 pandemic.

Suspension of monetary thresholds for transactions requiring FIRB approval

From 10:30 pm, 29 March 2020, the monetary thresholds for substantial interests attracting the obligation to obtain Foreign Investment Review Board (FIRB) approval have been reduced to $0.

Flexibility schedule added to Clerks Private Sector Award

On Saturday 28 March 2020, the Fair Work Commission (FWC) full bench (presided by President Iain Ross, Deputy President Richard Clancy and Commissioner Michelle Bissett) granted a joint application made by the Ai Group and Australian Chamber of Commerce and Industry on 26 March 2020 to insert a COVID-19 flexibility schedule in the Clerks Private Sector Award (Award). The application was supported by the Australian Services Union and the Australian Council of Trade Unions.

New Australian export controls on goods during the COVID-19 crisis

Further to our update last week, the government has now moved to impose export controls on COVID-19 goods during the present ‘human biosecurity period’.

How will COVID-19 impact your business contracts

The COVID-19 pandemic is having an unprecedented impact on the economy. The effects of escalating government counter-measures will change the way we do business for the foreseeable future.

Construction contracts in the era of COVID-19

The impacts of COVID-19 mean that key aspects of a construction project may need to be reconsidered. The correct approach will depend on a range of factors, including the stage at which your project is impacted.

Australian and international supply chain responses to COVID-19

In light of the ongoing and increasing impact of COVID 19, here we summarise a few relevant issues in the international supply chain, including at our national border.

Drafting a Will and Powers of Attorney in self-isolation

The COVID-19 medical emergency highlights the importance of having a Will and Powers of Attorney in place. Now is the time to ensure you – and your loved ones – are protected by guaranteeing you have valid and effective medical and financial documents prepared.

Countries and States may shut borders, but freight and logistics cannot be interrupted

With the COVID-19 pandemic continuing to spread and both State and Federal Governments announcing changes to their response policies daily, there has been understandable concern about the continued operation of the supply chain domestically and internationally.

Protecting personal information in a pandemic

All Australian organisations are facing unfamiliar challenges and pressures as they manage and adapt their business operations in these unprecedented times. It is definitely not “business as usual”.

However, it is important for businesses not to lose sight of their privacy and data protection obligations during this time. This is particularly so as businesses are collecting more detailed and sensitive information about employees, contractors, visitors and other individuals that interact with their business to help manage the spread of COVID-19 and many workplaces have moved to remote working arrangements.

Addressing COVID-19 concerns in today’s M&A deal environment

Today’s M&A deal environment is uncertain. Whilst it is still relatively early days, at the time of writing, COVID-19 has already significantly impacted the basic logistics of running the sale process as countries close borders and ban employees from travelling.

COVID-19 flexibility schedule added to Hospitality Industry Award

Last night, the Fair Work Commission granted a joint Australian Hotels Association and United Workers Union application to insert a COVID-19 flexibility schedule in the Hospitality Industry (General) Award 2010 (Award), which will operate from 24 March 2020 until 30 June 2020, with a possible extension upon application.

VCGLR announces expedited take-away liquor licences

To support the hospitality industry, the Victorian Commission for Liquor Licencing and Gambling Regulation (VCGLR) has announced a special temporary limited licence free of charge available to current liquor licensees that may be granted within 72 hours from application lodgement.

Suspension of insolvency laws in response to COVID-19

On Monday 23 March 2020, the federal parliament passed the Coronavirus Economic Response Package Omnibus Act 2020 (Cth) implementing a range of urgent measures announced by the government on Sunday 22 March 2020.

Coronavirus pandemic emergency legislation passed by Parliament

On 23 March 2020, the Federal Government urgently passed legislation to introduce economic stimulus measures to address the impact of the coronavirus pandemic.

The two packages of measures, worth $17.6 billion and $66 billion, combined with the relief provided by the Reserve Bank of Australia and the Government’s support to smaller lenders, brings total support to $189 billion.

Know your lease rights and obligations

The current COVID-19 situation brings uncertain and unsettling times.

Rigby Cooke has received several enquiries from landlords and tenants alike regarding their rights and obligations under their lease.

Tax stimulus package for businesses in response to the Coronavirus

On 12 March 2020, the Government announced a stimulus package totalling $17.6 billion to address the economic impacts of the Coronavirus outbreak. Included in the package are tax incentives and cash flow assistance for businesses, in order to support investment and help small businesses manage short-term cash flow challenges.