The State Taxation Acts Amendment Act 2025 (Act) has been enacted in Victoria, following the State Taxation Acts Amendment Bill 2025 receiving Royal Assent on 24 June 2025.

News & Insights

Our latest news and insights

A collection of articles, case studies and media releases highlighting the latest in legal news and at Rigby Cooke Lawyers.

Rigby Cooke Lawyers welcomes Steven Apostolou as Lead Partner of Property

Rigby Cooke Lawyers is delighted to welcome Steven Apostolou as the Lead Partner of our Property practice, commencing on 1 July 2025.

Miglic decision upheld in Victorian Supreme Court of Appeal

Today, the Court of Appeal unanimously upheld the decision of the Supreme Court of Victoria in Re Miglic [2024] VSC 20, in which two sisters proved the existence of a 30-year-old oral agreement affecting husband and wife wills.

It’s time to clean up your waste management agreements

In recent months, we have observed that commercial waste management companies are increasingly using standard form contracts containing unfair terms. Notably, these unfair terms (specifically in waste management agreements) were declared to be unfair in the case of ACCC v JJ Richards [2017] FCA 1224.

Changes to who can work in licensed premises in Australia

Recent amendments to Australia’s customs laws have made significant changes to who can work in licensed premises — such as warehouses, depots and bond stores — with a strong focus on bolstering supply chain security.

Tort for serious invasions of privacy is now in effect

A new statutory tort for serious invasions of privacy came into effect on Tuesday 10 June, 2025. This new tort was introduced under the Privacy and Other Legislation Amendment Act 2024 (Cth) and provides an avenue for individuals to seek damages against persons or companies that commit a serious invasion of privacy — either through intrusion into their personal space or misuse of their information.

Prevention is better than cure — navigating shareholder disputes in the transport and logistics industry

Shareholder disputes affect companies of all sizes across all industries in Australia and are far more common than you might think. The transport and logistics industry is certainly not immune.

Are your employees working unreasonable additional hours?

When your employees are regularly working hours beyond their contracted hours, or beyond 38 hours per week, there is a risk they will claim those additional hours are ‘unreasonable’.

We have summarised the law surrounding this claim and lessons from recent cases.

Vale Nicholas Holt 1937-2025

It is with deep sadness that Rigby Cooke Lawyers shares the news of the passing of our esteemed colleague and friend, Nicholas Holt (Nick).

Risks of DIY Will kits — save now but your Estate may have to pay later

Case note: Sorati & Anor v Sorati [2025] QSC 14

Preparing a Will can seem like one of life’s administrative burdens. For many, the easiest and cheapest solution to deal with that burden is to download an ‘off the shelf’ Will template or a Will Kit you can purchase at the post office or newsagency.

This might seem like a cheap and effective outcome now, but beware of the risks as it could significantly increase legal and other costs for your Estate, or be the cause of disputes between family members, resulting in an irretrievable relationship breakdown.

Presumption of recovery of damages due to the breach of an agreement

Case note: Cessnock City Council v 123 259 932 Pty Ltd [2024] HCA 17

The usual basis for a claimant to be compensated when a contract is breached is one of being restored to the same position it would have been in, had the contract been performed. In order to be awarded that compensation, the claimant needs to demonstrate that the loss arises from that breach.

Preparing for 1 July 2025 (and beyond) – including wages and superannuation increases

On 3 June 2025, the Fair Work Commission handed down its 2025 Annual Wage Review decision.

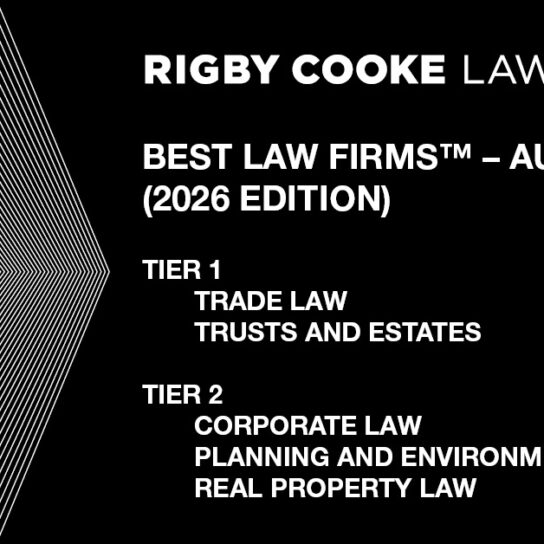

Rigby Cooke Lawyers recognised in Best Law Firms™ – Australia (2026 Edition)

Rigby Cooke Lawyers is delighted to share that we have been recognised among the best law firms in Melbourne for five areas of law in the second edition of Best Law Firms™ – Australia.

Navigating the complex path of refusing flexible working arrangement requests

Case note: Naden v Catholic Schools Broken Bay Limited as Trustee for the Catholic Schools Broken Bay Trust [2025] FWCFB 82

The Full Bench of the Fair Work Commission (FWC) has held that a school wrongly refused a teacher’s flexible working arrangement request, because its response did not meet all of the requirements set out in the Fair Work Act 2009 (Cth) (FW Act).

Have you been subpoenaed?

Being served with a subpoena can be stressful and daunting. However, you should not delay or fail to act upon receiving a subpoena.

Outlined below are key features of subpoenas.

Have you been doxxed? Here’s what you need to know

In response to growing concerns over online harassment and the malicious exposure of personal information, the Australian Government introduced new criminal offences targeting doxxing in the Privacy and Other Legislation Amendment Act 2024 (Cth) in December 2024.

In this article, we explain doxxing and the two new criminal offences, which are now part of the Criminal Code Act 1995 (Cth).

Stronger whistleblowing laws and the new Aged Care Act

The Aged Care Act 2004 (Cth) (Act) commences 1 July this year. The Act promotes the rights of those who access aged care services funded by the Australian Government and includes changes centred around the needs of patients. The reform comes as a result of concerns about various unsatisfactory examples of substandard care raised before the Royal Commission into Aged Care Quality and Safety, established in 2018.

Businesses beware — individuals can now claim damages for a serious invasion of privacy

In late 2024, the Privacy and Other Legislation Amendment Act 2024 (Cth) introduced a new statutory tort for serious invasion of privacy. This development marks a significant evolution in the Australian privacy law legal landscape, providing individuals with a clear and actionable right to seek redress for serious breaches of their privacy. It reflects growing public concern over personal information misuse and affirms the importance and value placed on privacy protection.

In this article, we explain the elements of the new tort of the serious invasion of privacy, the defences available for defendants and the damages available to complainants.

Drug and alcohol policies in the spotlight again — policies need to be clear and understood by employees

Over recent months, the Fair Work Commission (FWC) has decided on a number of cases involving disputes over breaches of workplace alcohol and drug (AD) policies.

In Benjamin Unicomb v SESLS Industrial Pty Ltd (U2024/8974), the FWC found that the termination of an employee for breaching the AD policy was unfair, and that employers need to consider if employees have understood the policy before the employee is sacked.

Victorian State Budget 2025-26 — Revenue measures explained

On 20 May 2025, Treasurer Jaclyn Symes handed down the Victorian State Budget 2025-26. While no new taxes have been announced, there is no relief in sight for landowners in respect of the various taxes currently in place. These include transfer duty, land tax, vacant residential land tax, foreign purchaser additional duty, absentee owner surcharge, and windfall gains tax.

Outcomes from the Australian federal election

The Australian federal election held on 3 May 2025 resulted in a decisive victory for the incumbent Australian Labor Party (ALP), which not only increased its majority in the House of Representatives but also expanded its presence in the Senate. This strengthened position enhances the ALP government’s ability to pass legislation to advance its policy initiatives.

Following these changes, there will be impacts for certain industries arising from the election.

Employee or contractor — FWC decision

Case note: Ms Jessica Dickson v Mr Felipe Cespedes & Susann Kovacs [2025] FWC 1218

The Fair Work Commission (FWC) has found a nanny who was paid cash-in-hand and who had agreed to be labelled as a contractor was an employee for the purposes of dealing with a general protections dismissal dispute. In the decision, Deputy President Butler examined the ordinary meanings of employee and employer and their relationships with the meaning of contractor.

Avoiding common disputes in contractual dealings

Contracts are the foundation upon which legal rights, obligations and expectations are built. The essential function of a contract is to create a binding legal relationship between contracting parties. In theory, they are designed to clearly define the mutual understanding and commitments made by the contracting parties. However, in practice, this clarity is not always reflected in the final contract terms. This can lead to unnecessary disputes, often resulting in protracted and costly litigation.

Duty of disclosure — claimants in family provision proceedings

Recent decisions of the Victorian and Tasmanian Supreme Courts have highlighted the onus on claimants for family provision from deceased estates to provide adequate evidence of their own financial circumstances.1

Transport coordinator dismissal — what went wrong?

Case note: Thomas Trevan v Vardan Towing & Transport Pty Ltd [2025] FWC 49

Unfair dismissal cases are the last thing a transport operator wants to see landing on their desk. A recent case in the Fair Work Commission (FWC) is an example of how it can go wrong if you don’t address the issue squarely.

Removing occupiers from deceased estate properties — Order 53 applications

Case note: Damou v Damou & Anor [2025] VSC 14

A common problem faced by executors and administrators of deceased estates is how to deal with people continuing to occupy a property owned by a deceased person. Often, the occupier of the property is a child or relative of the deceased who has been given informal permission to stay in the property by the deceased, instead of through a formal lease with rent being paid.

A recent decision of the Supreme Court of Victoria (Court) in Damou v Damou & Anor [2025] VSC 14 (Damou) highlights the issues that executors and administrators ought to consider before commencing proceedings seeking the removal of occupiers in those circumstances.

Knowing the unknown and dealing with the knowns in trade and customs

A version of this article was published in the April /May 2025 edition of The DCN. Please note that this was written before the ‘Liberation Day’ tariffs were announced in the US and before the Australian Federal Election.

There have been concerns as to the absence of a clear system or rationale for the various measures and policies being introduced, making it impossible to predict future actions by the United States (US). This can be compared to the Australian regime where proposed developments in policy and legislation are somewhat clearer.

In our latest Customs & Trade alert, Andrew Hudson unravels what the US Government’s incoming trade and customs policies could mean for Australia with the current federal election.

Six Rigby Cooke Lawyers’ partners named in 2026 edition of The Best Lawyers in Australia™

Rigby Cooke Lawyers is delighted to share that six of our esteemed partners have been recognised across eight areas of law in the 2026 edition of The Best Lawyers in Australia™.

FWC upholds employee’s right to flexible working arrangements for childcare responsibilities

Case note: Kent Aoyama v FLSA Holdings Pty Ltd [2025] FWC 524

The Fair Work Commission (FWC) has ordered a workplace to allow an employee to work an additional day per fortnight at home to be with his young child. The FWC decision came about after the employee’s individual flexibility arrangement (IFA) request was denied.

Updates to the Privacy Act and Australian Privacy Principles

On 10 December 2024, the Privacy and Other Legislation Amendment Act 2024 (Cth) received Royal Assent introducing significant amendments to the Privacy Act 1988 (Cth) (Privacy Act) and the Australia Privacy Principles (APPs).

Security of payment in Victoria — retention monies claimable as a payment claim

Case note: J.G. King Project Management Pty Ltd v Hunters Green Retirement Living Pty Ltd [2024] VSCA 310

President Trump announces ‘Liberation Day’ tariffs to take effect from 5 April 2025

In a televised address on 2 April 2025, President Trump has announced the imposition of the anticipated ‘reciprocal’ tariffs on global exports into the United States (US), together with some of the reasons for those tariffs being imposed.

Government’s move to outlaw non-compete clauses — A long-awaited reform or just another announcement?

The government’s announcement seeking to outlaw non-compete clauses in employment agreements, which was announced earlier this week by Treasurer Jim Chalmers as part of the Federal Budget 2025-26 (Budget), is not news. Nor is it a surprise.

Rigby Cooke Lawyers’ Rhodie Anderson, Reto Hofmann, and Planning & Environment practice have been recognised in the 2025 Doyle’s Guides

We are delighted to share that Rhodie Anderson — Partner, Reto Hofmann — Special Counsel, and our Planning & Environment practice have been recognised in the 2025 Doyle’s Planning & Environment Guides for Victoria.

Federal Budget 2025-26 — trade, border security, transport, agriculture and manufacturing measures announced

On 25 March 2025, Treasurer Jim Chalmers delivered the Federal Budget for 2025-26 (Budget) announcing significant measures in relation to trade, border security, infrastructure, transport and manufacturing.

Federal Budget 2025-26 — Taxation measures

On 25 March 2025, Treasurer Jim Chalmers handed down the Federal Budget 2025-26 announcing a budget deficit ahead of the upcoming federal election.

ATO warns of increasing risk of director penalty notices — what you need to know

The last 12 months has seen an escalation in debt collection activities instigated by the Australian Taxation Office (ATO) with respect to businesses, resulting in a subsequent increase in the rate of insolvencies. Where the ATO is unable to recover a tax debt directly from a company due to liquidity issues, it can seek to recover those debts personally from directors, via the director penalty regime.

Understanding the new Fair Work Commission powers for gig workers and contractors

From 26 February 2025, independent contractors can file claims in the Fair Work Commission (FWC) to set aside unfair contract terms.

In addition, while eligible employees have long had unfair dismissal protections, some gig workers and contractors are able to apply to the FWC under new unfair deactivation and termination provisions.

Il Mercato Centrale now fully vindicated with third consecutive win, this time in the High Court of Australia

Yesterday, on behalf of our client Mercato Centrale Australia Pty Ltd, Rigby Cooke Lawyers successfully defeated an application by Caporaso Pty Ltd to the High Court of Australia for special leave to appeal the Full Court decision of 6 December 2024, whereby Caporaso Pty Ltd’s MERCATO trade mark was ordered to be deregistered.

International Women’s Day 2025 — Stepping forward in solidarity to help #AccelerateAction for gender equality

At Rigby Cooke Lawyers, we strive to cultivate an environment that empowers all individuals, regardless of gender, to excel and reach their full potential.

A win for Family Trusts — the ATO loses its fight in the Full Federal Court

On 19 February 2025, the decision of the Full Federal Court in FCT v Bendel (2025) FCAFC 15 (Bendel) was handed down. In this case, the Court overturned the long-held view of the Australian Taxation Office (ATO) that an unpaid present entitlement (UPE) of a corporate beneficiary is a loan for the purposes of Division 7A of the Income Tax Assessment Act 1936 (ITAA 1936).

Rigby Cooke Lawyers’ Rob Jackson, Sam Eichenbaum, Elise Jasper, and Workplace Relations practice recognised in the 2025 Doyle’s Employment Guides

We are delighted to share that Rob Jackson — Partner, Sam Eichenbaum — Senior Consultant, Elise Jasper — Associate, and our Workplace Relations practice have been recognised in the Doyle’s Employment Guides for Victoria, 2025.

Welcome to 2025 and more challenges in the supply chain

A version of this article was published in the February/March 2025 edition of The DCN.

Each year, the global supply chain experiences a series of unexpected disruptions, requiring those in the supply chain to adapt quickly to manage them. In this article, Andrew Hudson reflects on the global supply chain challenges of 2024 that will shape the new year.

Rigby Cooke Lawyers is delighted to welcome Andrew Gale and Hendrik Wise, our talented law graduates for 2025

Earlier this week, we had the pleasure of welcoming Andrew Gale and Hendrik Wise as part of our 2025 Graduate Program.

Injured worker succeeds in breach of contract claim over how he was dismissed

Case note: Elisha v Vision Australia Limited [2024] HCA 50

Until recently, it has long been the case in Australian law that courts would not award damages for breach of contract because of the way in which the worker was dismissed.

In Elisha v Vision Australia Limited [2024] HCA 50, the High Court decision resulted in an employer being liable for almost $1.5 million to an employee for breaching his contract by failing to follow its disciplinary policy when terminating that employee’s employment.

Importing Goods: Overview (Australia)

Published by Thomson Reuters’ Practical Law, this Practice Note authored by Andrew Hudson, Partner in our Customs & Trade practice, provides a general overview of key substantive issues to consider when importing goods into Australia, including requirements enforced by the Australian Border Force (ABF) under the Customs Act 1901 (Cth) and related legislation and by the Department of Agriculture, Fisheries, and Forestry (DAFF) under the Biosecurity Act 2015 (Cth) and related legislation.

New inquiry into transport security legislation amendments

While heavily regulated, the transport and logistics industry continues to experience increasing and expanded security threats. The most recent threats are cyber threats, smuggling of tobacco, vapes and other illicit substances. Late last year, new legislation was introduced into Parliament that reflects the need for increased security in the transport industry.

Show me the money — Executors be wary of making distributions to beneficiaries in haste

Case note: Re Estate of Hagendorfer (Injunction) [2024] VSC 482

The Supreme Court of Victoria’s decision in Re Estate of Hagendorfer (Injunction) [2024] VSC 482 (Hagendorfer) highlights the importance for executors and administrators to exercise caution before distributing an estate, having granted an injunction which effectively froze funds distributed early, pending the determination of a claim against the estate.

“It’s my first day back”— What President Trump did when inaugurated again

A version of this article was published in January 2025 in The DCN.

The first day of ‘Trump 2.0’ marked a bold re-entry into power. While his inauguration speech reaffirmed his commitment to promises to make America great again, the day itself was filled with significant and controversial decisions that could shape the course of his second presidential term.

It’s a new year and time to update your Will

For most of us, a new year brings new beginnings and opportunities. With the holiday season now behind us, this is the perfect time to create or update your estate planning including your Will before you get caught up in the daily routine of another year.

Expansion of Vacant Residential Land Tax from 1 January 2025

From 1 January 2025, the scope of the Vacant Residential Land Tax (VRLT) is significantly broadening and will impact numerous property owners.

The VRLT is wholly separate from the standard land tax and will lead to many properties being hit with both forms of taxes on an annual basis if the risk of exposure is not managed. While both taxes are contained in the Land Tax Act 2005 (Vic), the regime for the VRLT is separate from the land tax regime and any exemptions will need to be carefully considered and managed.

Trump 2.0 — be alert, not alarmed!

A version of this article was first published in December 2024/January 2025 edition of The DCN.

In our latest Customs & Trade alert, Andrew Hudson shares his thoughts on navigating the trade world with a new Trump administration – which he calls Trump 2.0.

Possible ILA strike in the US becomes more likely from 15 January 2025

On 1 October 2024, a short strike commenced in the United States (US) by the East Coast and Gulf Coast dockworkers represented by the International Longshoremen’s Association (ILA). The strike was the first large–scale strike in nearly 50 years, halting the flow of approximately 50 percent of the US ocean shipping. It took place after negotiations for a new labour contract, which dealt with wages and terminal automation project issues, collapsed. The ILA does not appear keen to adopt new automation issues, viewing them as a threat to ongoing work of its members.

Executor and trustee receives jail time for acting badly

A series of recent decisions of the Supreme Court of Victoria in Fahey v Bird1 highlights:

- the importance for executors and trustees to keep adequate and accurate financial records of their administration of estates and trusts respectively;

- executors have a positive duty to respond to beneficiaries’ requests for information; and

- the dire consequences that might ensue when such duties are breached.

In this article, Marcus Schivo reflects on the various judgments which considered the behaviour of the executor and more particularly the breaches which resulted in him being jailed.

Tamara Cardan appointed to Property Council’s Victorian Tax and Economic Trends Committee for 2025/2026

Rigby Cooke Lawyers’ Tamara Cardan, Special Counsel in our Corporate & Commercial and Tax teams has been appointed as a committee member of the Property Council of Australia’s Tax and Economic Trends committee in Victoria.

Congratulations Arielle Vlahiotis and Jenna Bayindir on their admission to the Supreme Court of Victoria

Rigby Cooke Lawyers is delighted to share that Arielle Vlahiotis and Jenna Bayindir were admitted as lawyers to the Supreme Court of Victoria earlier today.

Full Court of the Federal Court of Australia vindicates Il Mercato Centrale decision on trade mark

On Friday 6 December 2024, the Full Court of the Federal Court of Australia dismissed the appeal against the decision of Justice Charlesworth on 26 February 2024 where her Honour ruled that Mercato Centrale Australia Pty Ltd’s use of the name ‘Il Mercato Centrale’ did not infringe the registered trade mark ‘MERCATO’ held by Caporaso Pty Ltd.

How transport and logistics companies may mitigate risk with contractual liens

In today’s uncertain economic climate, marked by inflation and high interest rates, many industries are struggling with clients who are late on payments. The transport and logistics sector is no exception. However, these companies may mitigate their risks by including contractual liens in their service agreements.

Andrew Hudson recognised as one of the world’s leading practitioners in the Lexology Index Trade & Customs 2024

Rigby Cooke Lawyers’ Andrew Hudson, Partner in our Customs & Trade group, has been recognised as one of the world’s leading practitioners in the Lexology Index Trade & Customs 2024 report.

New off-the-plan concession soon to become law

Legislation introducing a temporary concession from transfer duty for newly constructed dwellings in strata subdivisions has passed the Victorian Legislative Council and is currently awaiting Royal Assent.

The Duties Amendment (More Homes) Bill 2024 (the Bill) introduces a new off-the-plan concession for certain purchases where a contract to acquire property is entered into within a 12-month period commencing on 21 October 2024.

Increased Probate Office fees come into effect today!

Significant changes to the Supreme Court of Victoria’s Probate Office fees come into force today, Monday 18 November.

The changes include:

- increased estate filing fees based on the value of the estate;

- a new fee for re-advertising applications for grants of representation;

- a new fee for filing an amended originating motion in an application; and

- advertising an intention to apply for grants of representation i.e. grants of probate, which are no longer published on the Supreme Court website.

Australia inks new FTA deal with UAE

A version of this article was first published in the The DCN in October 2024.

As many readers would be aware, Australia has entered into several free trade agreements (FTA) whether bilateral, regional or plurilateral. Many of the FTAs have led to improvements in trade outcomes, including the recent FTAs with the United Kingdom and the first stage of the FTA with India.

When is a beer a ‘beer’? New ATO guidance causes headaches for manufacturers

On 28 August 2024, the Australian Taxation Office (ATO) issued a draft of its Excise Determination ED 2024/D2 (Draft Determination) outlining the Commissioner’s views on the definition of ‘beer’ for the purposes of excise duty. The effect of this draft guidance is to narrow the definition of ‘beer’, meaning that alcoholic beverages which do not fall within that definition will be subject to higher rates of excise duty.

Transition to the Administrative Review Tribunal and inquiry into Australia’s sanctions regime

In our latest Customs & Trade alert, Alexander Uskhopov — Associate in our Customs & Trade group breaks down the details of the new Administrative Review Tribunal as well as the parliamentary inquiry into the effectiveness of Australia’s sanction regime.

Should you register your domestic relationship?

In 2021, according to the Australian Bureau of Statistics, it was estimated that 8,747,135 people were married in Australia and 2,168,351 people were in a domestic relationship1. Whilst a domestic relationship is not legally a marriage, the parties of a domestic relationship can register their relationship and receive benefits similar to those of a married couple.

What’s the fuss on de minimis?

A version of this article was first published in the The DCN in September 2024.

Australia’s experience in dealing with de minimis transactions has been complicated and is now subject to review by industry and border agencies. Andrew Hudson, Partner — Customs & Trade, looks at Australia’s experience in dealing with low-value transactions and practices overseas.

Introducing Mark Gomez, Associate in our Property group

We are delighted to introduce Mark Gomez, Associate in our Property group.

Introducing Brighid Virtue, Associate in our Corporate & Commercial group

We are delighted to introduce Brighid Virtue, Associate in our Corporate & Commercial group.

Lease incentives and clawback provisions

Lease incentives offered by landlords to tenants have significantly evolved in recent times. Since the onset of COVID-19, there has been a substantial decline in commercial tenancies for various reasons, leading to an increased need for landlords to lure and entice tenants into signing new leases or renewing for additional terms.

In our latest Property alert, we explain what a lease incentive is, the purpose of the clawback clause, and the implications for both landlord and tenants when negotiating a lease.

Rigby Cooke Lawyers’ Rachael Grabovic, Christian Teese, Ashwin Reddy and the Wills, Trusts & Estates practice have been recognised in the 2024 Doyle’s Guide

Rigby Cooke Lawyers is delighted to announce that Rachael Grabovic — Partner & Notary Public, Christian Teese — Partner, Ashwin Reddy — Associate, and our Wills, Trusts & Estates practice have been recognised in the 2024 Doyle’s Wills & Estates Guides for Victoria.

Rigby Cooke Lawyers advises Stannards on its partnership with Pemba Capital Partners

Rigby Cooke Lawyers advised Stannards, a leading accounting and business advisory firm, on its partnership with Pemba Capital Partners (Pemba), a prominent investor in high-growth, entrepreneurial businesses.

Can I exclude all liability in a contract?

As a transport and logistics operator, while you cannot exclude all liability, you can limit your liability.

Trying to exclude all liability is extremely high-risk, if not impossible.

How well do you know your customers and employees?

The Australian Border Force (ABF) has introduced new customs broker licensing conditions effective from 1 July 2024. These new conditions placed upon licensed customs brokers (brokers) complement more stringent conditions previously imposed on bonded warehouse and depot licences introduced in November 2022.

What you need to know about the windfall gains tax

The windfall gains tax (WGT) is a new tax that is imposed on the increase in value of property in Victoria as a result of a rezoning of that land.

Around the nation with IFCBAA CPD forums

A version of this article was first published in the print edition of The DCN for August 2024.

Trade law expert Andrew Hudson shares a roundup of matters discussed at recent CPD forums throughout Australia.

Introducing Maddy Lodge, Lawyer in our Workplace Relations group

We are delighted to introduce Maddy Lodge, Lawyer in our Workplace Relations group.

What the transport and logistics industry needs to know about the updated unfair contract terms regime

The Unfair Contract Terms (UCT) regime has been updated to broaden its application and impose penalties for breach and has been in effect since 9 November 2023.

Binding death benefit nominations – when is the end of a de facto relationship considered the end?

Case note: Nguyen v Australian Financial Complaints Authority (2024) FCAFC 77

The Federal Court’s recent Full Court decision in Nguyen v Australian Financial Complaints Authority (2024) FCAFC 77 (Nguyen v AFCA) should be a timely reminder to review and update your estate planning documents in the event of a de facto relationship coming to an end.

Proposed probate filing fees – the Victorian Government’s new revenue stream

On 20 June 2024, the Victorian Government announced the Department of Justice and Community Safety (the department) would lead a review of fees charged for services provided by the Victorian Probate Office within the Supreme Court.

As part of its review, the department sought community feedback in which Rigby Cooke Lawyers’ Wills, Trusts & Estates group provided a submission expressing its concerns on the proposed fee structures and increase in probate fees.

Australian Government announces the launch of the Administrative Review Tribunal

In a significant development for Australia’s administrative review landscape, the Australian Government has unveiled plans to launch the Administrative Review Tribunal (ART) on 14 October, 2024.

This newly established federal body will replace the existing Administrative Appeals Tribunal (AAT), thereby implementing the Labor Government’s election promise to address what were seen as biased political appointments within the AAT.

Further tightening of the regime for licensed customs brokers

A version of this article was first published in the print edition of The DCN for July 2024.

In our latest Customs & Trade alert, Andrew Hudson summarises some of the relevant provisions to effect changes for licensed customs brokers.

New delegates rights clause inserted into awards

On 1 July 2024, a new clause was inserted into all 155 modern awards providing union workplace delegates specific rights in the workplace.

FWC rejects application to vary redundancy pay for employer’s failure to provide adequate redeployment offer

Applications by Ozland Mining Services Pty Ltd [2024] FWC 1439 and 1440

Rigby Cooke Lawyers promotes eight lawyers, including Victoria Comino and Christian Teese to partner, effective 1 July 2024

Rigby Cooke Lawyers is delighted to announce the promotion of eight lawyers across five practice areas.

AUKUS in focus

A version of this article was first published by The DCN in June 2024.

In an industry replete with acronyms, the AUKUS acronym has gained significant use and attention across the last few years.

With AUKUS now established and its members implementing legislative and administrative arrangements to facilitate the intended outcomes of the partnership, it is timely to examine some of its initiatives.

Rigby Cooke Lawyers appoints new commercial litigation and insolvency partner, Julie Callea-Smyth

Rigby Cooke Lawyers is delighted to announce the recent appointment of Julie Callea-Smyth, Partner in our Litigation & Dispute Resolution and Insolvency & Reconstruction practices.

Rigby Cooke Lawyers recognised in Best Law Firms™ – Australia

We are pleased to share the news that five of our practice areas, including Corporate & Commercial, Customs & Trade, Planning & Environment, Property and Wills, Trusts & Estates, have been recognised by Best Lawyers in their inaugural edition of Best Law Firms™ – Australia.

Preparing for 1 July 2024 (and beyond) — including wages and superannuation increases

On 3 June 2024, the Fair Work Commission handed down its 2024 Annual Wage Review Decision.

The Commercial and Industrial Property Tax is now law

On 21 May 2024, the Commercial and Industrial Property Tax Reform Act 2024 received Royal Assent, officially making the Commercial and Industrial Property Tax (CIPT) law. The new CIPT regime will apply to eligible transactions from 1 July 2024.

Vacant residential land tax — Extension of holiday home exemption

On 14 May 2024, the Victorian Government introduced the State Taxation Amendment Bill 2024 (Bill) into Parliament. The Bill (if passed) amends the Land Tax Act 2005 to expand the exemption from the vacant residential land tax (VRLT) for holiday homes.

An update on the Australian trade agenda with China

A version of this article was first published by The DCN in May 2024.

The relationship between Australia and China is a complex one, with the two countries having maintained common interests in trade.

Federal Budget 2024-25 — Trade, biosecurity, infrastructure, logistics and manufacturing measures announced

On 14 May 2024, Treasurer Jim Chalmers delivered the Federal Budget for 2024-25 (Budget) announcing significant measures in relation to trade, biosecurity, infrastructure, logistics and manufacturing.

Federal Budget 2024-25 — Taxation measures

On 14 May 2024, Treasurer Jim Chalmers handed down the Federal Budget 2024-25 announcing significant tax measures.

Congratulations Rachael Grabovic – winner of the STEP Australia Excellence Award, 2024

We are delighted to share the news that Rigby Cooke Lawyers’ Rachael Grabovic TEP, Partner and Notary Public in our Wills, Trusts & Estates group, was successful in winning the STEP Australia Excellence Award for 2024.

Rigby Cooke Lawyers’ Bill Karvela recommended for property law in the 2024 Doyle’s Guide

We are delighted to share the news that Bill Karvela, Managing Partner, and our Property practice have been recognised for their expertise within the areas of transactional property and real estate matters in the Doyle’s Property Guides for Victoria.

Introducing Thalia Livadaras, Senior Associate — Wills, Trusts & Estates

We are delighted to introduce Thalia Livadaras, Senior Associate in our Wills, Trusts & Estates group.

The Commercial and Industrial Property Tax — Details of the new measures

On 20 March 2024, the Commercial and Industrial Property Tax Reform Bill 2024 (Bill) was introduced into Victorian Parliament.

Ruby Princess High Court decision confirms that UCT laws extend beyond Australia’s borders

Case note: Karpik v Carnival plc [2023] HCA 39

In the recent class action case, Karpik v Carnival plc [2023] HCA 39 (Ruby Princess Case), the High Court of Australia has confirmed that where at least one party to a standard contract for goods or services is acting within, or carrying out business in, Australia the unfair contract term (UCT) laws will apply to that contract.

Congratulations Rachael Grabovic – finalist in the STEP Australia Excellence Awards 2024

Rigby Cooke Lawyers is delighted to share the news that Rachael Grabovic, Partner in our Wills, Trusts & Estates group, is a finalist in the Excellence Award category for the STEP Australia Excellence Awards 2024, which was announced earlier today.

Rigby Cooke Lawyers assists DSV Air & Sea in long-term lease at Port of Brisbane

Rigby Cooke Lawyers assisted DSV Air & Sea on its 10-year lease agreement with Port of Brisbane Pty Ltd (PBPL) for a warehouse and container hardstand on a 4.8ha site on Fisherman Islands, which was announced recently.