On 1 July 2025, the Victorian Government introduced the Aged Care Restrictive Practices Substitute Decision‑Maker Act 2024 (Vic) to allow a person to nominate another person to make decisions around restrictive practices in aged care through a new enduring document.

Category: Wills, Trusts & Estates

Our latest news and insights

A collection of articles, case studies and media releases highlighting the latest in legal news and at Rigby Cooke Lawyers.

Deceased estates with foreign executors — Australian tax implications

Administering a deceased estate can be a complex and time-consuming process, particularly when the deceased held substantial assets or had outstanding liabilities. The complexity increases significantly when assets are located across multiple jurisdictions.

In cases where an individual who owns property in Australia passes away while residing overseas, the executor may face unforeseen Australian tax consequences, especially when selling that property as part of the estate administration.

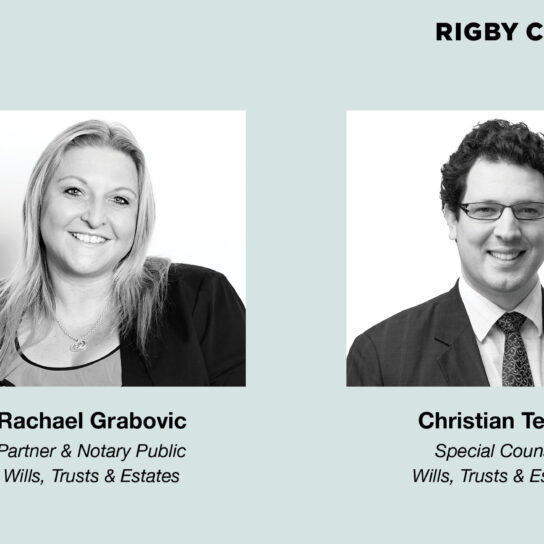

Rigby Cooke Lawyers’ Rachael Grabovic and Christian Teese named ‘leading’ lawyers in the Doyle’s Wills & Estates Guides for 2025

Rigby Cooke Lawyers is delighted to share that our Wills, Trusts & Estates partners, Rachael Grabovic and Christian Teese, have been named ‘leading’ lawyers in the 2025 Doyle’s Wills & Estates Guides for Victoria.

Miglic decision upheld in Victorian Supreme Court of Appeal

Today, the Court of Appeal unanimously upheld the decision of the Supreme Court of Victoria in Re Miglic [2024] VSC 20, in which two sisters proved the existence of a 30-year-old oral agreement affecting husband and wife wills.

Risks of DIY Will kits — save now but your Estate may have to pay later

Case note: Sorati & Anor v Sorati [2025] QSC 14

Preparing a Will can seem like one of life’s administrative burdens. For many, the easiest and cheapest solution to deal with that burden is to download an ‘off the shelf’ Will template or a Will Kit you can purchase at the post office or newsagency.

This might seem like a cheap and effective outcome now, but beware of the risks as it could significantly increase legal and other costs for your Estate, or be the cause of disputes between family members, resulting in an irretrievable relationship breakdown.

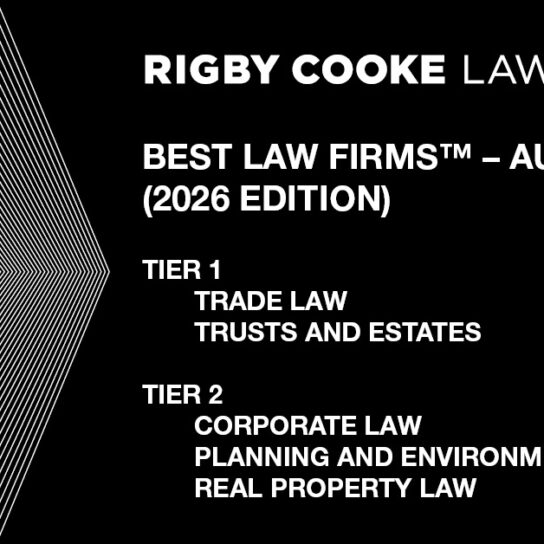

Rigby Cooke Lawyers recognised in Best Law Firms™ – Australia (2026 Edition)

Rigby Cooke Lawyers is delighted to share that we have been recognised among the best law firms in Melbourne for five areas of law in the second edition of Best Law Firms™ – Australia.

Duty of disclosure — claimants in family provision proceedings

Recent decisions of the Victorian and Tasmanian Supreme Courts have highlighted the onus on claimants for family provision from deceased estates to provide adequate evidence of their own financial circumstances.1

Removing occupiers from deceased estate properties — Order 53 applications

Case note: Damou v Damou & Anor [2025] VSC 14

A common problem faced by executors and administrators of deceased estates is how to deal with people continuing to occupy a property owned by a deceased person. Often, the occupier of the property is a child or relative of the deceased who has been given informal permission to stay in the property by the deceased, instead of through a formal lease with rent being paid.

A recent decision of the Supreme Court of Victoria (Court) in Damou v Damou & Anor [2025] VSC 14 (Damou) highlights the issues that executors and administrators ought to consider before commencing proceedings seeking the removal of occupiers in those circumstances.

Six Rigby Cooke Lawyers’ partners named in 2026 edition of The Best Lawyers in Australia™

Rigby Cooke Lawyers is delighted to share that six of our esteemed partners have been recognised across eight areas of law in the 2026 edition of The Best Lawyers in Australia™.

Show me the money — Executors be wary of making distributions to beneficiaries in haste

Case note: Re Estate of Hagendorfer (Injunction) [2024] VSC 482

The Supreme Court of Victoria’s decision in Re Estate of Hagendorfer (Injunction) [2024] VSC 482 (Hagendorfer) highlights the importance for executors and administrators to exercise caution before distributing an estate, having granted an injunction which effectively froze funds distributed early, pending the determination of a claim against the estate.

It’s a new year and time to update your Will

For most of us, a new year brings new beginnings and opportunities. With the holiday season now behind us, this is the perfect time to create or update your estate planning including your Will before you get caught up in the daily routine of another year.

Executor and trustee receives jail time for acting badly

A series of recent decisions of the Supreme Court of Victoria in Fahey v Bird1 highlights:

- the importance for executors and trustees to keep adequate and accurate financial records of their administration of estates and trusts respectively;

- executors have a positive duty to respond to beneficiaries’ requests for information; and

- the dire consequences that might ensue when such duties are breached.

In this article, Marcus Schivo reflects on the various judgments which considered the behaviour of the executor and more particularly the breaches which resulted in him being jailed.

Increased Probate Office fees come into effect today!

Significant changes to the Supreme Court of Victoria’s Probate Office fees come into force today, Monday 18 November.

The changes include:

- increased estate filing fees based on the value of the estate;

- a new fee for re-advertising applications for grants of representation;

- a new fee for filing an amended originating motion in an application; and

- advertising an intention to apply for grants of representation i.e. grants of probate, which are no longer published on the Supreme Court website.

Should you register your domestic relationship?

In 2021, according to the Australian Bureau of Statistics, it was estimated that 8,747,135 people were married in Australia and 2,168,351 people were in a domestic relationship1. Whilst a domestic relationship is not legally a marriage, the parties of a domestic relationship can register their relationship and receive benefits similar to those of a married couple.

Rigby Cooke Lawyers’ Rachael Grabovic, Christian Teese, Ashwin Reddy and the Wills, Trusts & Estates practice have been recognised in the 2024 Doyle’s Guide

Rigby Cooke Lawyers is delighted to announce that Rachael Grabovic — Partner & Notary Public, Christian Teese — Partner, Ashwin Reddy — Associate, and our Wills, Trusts & Estates practice have been recognised in the 2024 Doyle’s Wills & Estates Guides for Victoria.

Binding death benefit nominations – when is the end of a de facto relationship considered the end?

Case note: Nguyen v Australian Financial Complaints Authority (2024) FCAFC 77

The Federal Court’s recent Full Court decision in Nguyen v Australian Financial Complaints Authority (2024) FCAFC 77 (Nguyen v AFCA) should be a timely reminder to review and update your estate planning documents in the event of a de facto relationship coming to an end.

Proposed probate filing fees – the Victorian Government’s new revenue stream

On 20 June 2024, the Victorian Government announced the Department of Justice and Community Safety (the department) would lead a review of fees charged for services provided by the Victorian Probate Office within the Supreme Court.

As part of its review, the department sought community feedback in which Rigby Cooke Lawyers’ Wills, Trusts & Estates group provided a submission expressing its concerns on the proposed fee structures and increase in probate fees.

Rigby Cooke Lawyers promotes eight lawyers, including Victoria Comino and Christian Teese to partner, effective 1 July 2024

Rigby Cooke Lawyers is delighted to announce the promotion of eight lawyers across five practice areas.

Rigby Cooke Lawyers recognised in Best Law Firms™ – Australia

We are pleased to share the news that five of our practice areas, including Corporate & Commercial, Customs & Trade, Planning & Environment, Property and Wills, Trusts & Estates, have been recognised by Best Lawyers in their inaugural edition of Best Law Firms™ – Australia.

Congratulations Rachael Grabovic – winner of the STEP Australia Excellence Award, 2024

We are delighted to share the news that Rigby Cooke Lawyers’ Rachael Grabovic TEP, Partner and Notary Public in our Wills, Trusts & Estates group, was successful in winning the STEP Australia Excellence Award for 2024.

Introducing Thalia Livadaras, Senior Associate — Wills, Trusts & Estates

We are delighted to introduce Thalia Livadaras, Senior Associate in our Wills, Trusts & Estates group.

Congratulations Rachael Grabovic – finalist in the STEP Australia Excellence Awards 2024

Rigby Cooke Lawyers is delighted to share the news that Rachael Grabovic, Partner in our Wills, Trusts & Estates group, is a finalist in the Excellence Award category for the STEP Australia Excellence Awards 2024, which was announced earlier today.

Rigby Cooke Lawyers’ partners named in the 17th edition of The Best Lawyers in Australia™

We are pleased to announce that five of our esteemed partners have been recognised in the 17th edition of The Best Lawyers in Australia™.

30-year-old oral agreement binds widow

Case note: Re Miglic [2024] VSC 20

On 8 February 2024, in the Trusts, Equity & Probate Division of the Supreme Court of Victoria, Justice Gorton handed down a decision which was largely dependent on proving the existence of a 30-year-old oral agreement affecting husband and wife wills.

Digital statutory declarations look set to become permanent

Yesterday, the federal government introduced the Statutory Declarations Amendment Bill 2023 (the Bill) to make permanent the use of digital execution — electronic signatures and video-link witnessing — in place of the traditional ink and paper.

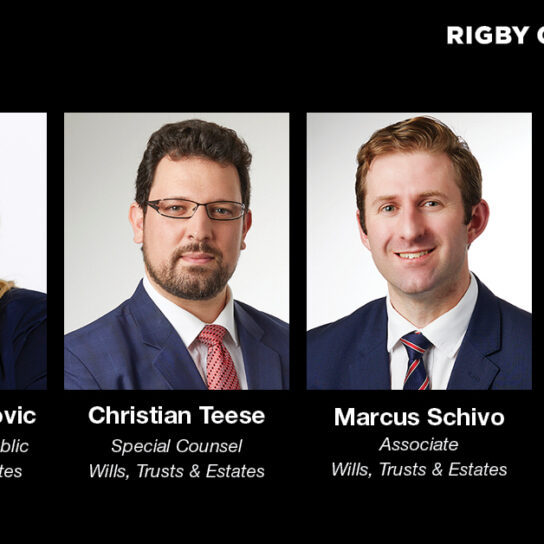

Rigby Cooke Lawyers’ Rachael Grabovic, Christian Teese, Marcus Schivo and Wills, Trusts & Estates practice recognised in the 2023 Doyle’s Wills & Estates Guides

Rigby Cooke Lawyers is pleased to announce that Rachael Grabovic — Partner & Notary Public, Christian Teese — Special Counsel, Marcus Schivo — Associate, and our Wills, Trusts & Estates practice have been recognised in the Doyle’s Wills & Estates Guides for 2023.

What you need to know about binding death benefit nominations

Most industry and retail superannuation funds, and almost all self-managed superannuation funds (SMSF), allow fund members to make binding death benefit nominations (BDBN).

Common myths and misconceptions in Wills and estate planning

There are many myths and misunderstandings surrounding Wills and estate planning, which often come from television shows and movies. This can lead to misconceptions and half-truths when people attend to their own estate planning, or when dealing with the estate of a deceased family member or friend.

Six partners from Rigby Cooke Lawyers named in the 16th edition of The Best Lawyers in Australia™

Rigby Cooke Lawyers is pleased to announce that six of our esteemed partners across six practice areas have been recognised in the 16th edition of The Best Lawyers in Australia™.

Who is a ‘dependant’ under superannuation legislation?

While many people make a Will thinking they can leave their estate assets, including their superannuation benefits, to any person they choose, the Superannuation Industry (Supervision) Act 1993 (Cth) (Act) defines who qualifies to receive a superannuation death benefit following the death of a fund member.

What happens to my superannuation when I die?

Two frequently asked questions we receive from our clients with respect to superannuation are:

Investigating testamentary capacity — who pays?

Dealing with the loss of a loved one is enormously difficult. It is even more difficult when there is an issue regarding the potential decline in the cognitive function of that loved one.

Compensation claims in the Guardianship List of VCAT

An attorney appointed to manage the financial and legal affairs of a principal has legislative duties they must adhere to. When an attorney breaches these duties and causes financial loss to the estate of the principal, what actions can be taken?

When a Will is not enough — dealing with non-estate assets

A discretionary trust, more commonly known as a ‘Family Trust’ is a common investment vehicle used by families and family business owners around Australia to hold assets or to run their family business.

Self-managed superannuation funds and binding death benefit nominations — what the High Court has to say

A recent decision of the High Court of Australia has confirmed that members of self-managed superannuation funds (SMSFs) can make binding death benefit nominations (BDBNs) which do not have to be witnessed, and do not expire or lapse, subject to the terms of the trust deed of their SMSFs.

Rigby Cooke Lawyers’ Rachael Grabovic, Christian Teese and Wills, Trusts & Estates team recognised in Doyle’s Guide 2022

Rigby Cooke Lawyers is pleased to announce that Partner Rachael Grabovic, Special Counsel Christian Teese and our Wills, Trusts & Estates team have again been recognised in the Doyle’s Wills & Estates Guides for 2022.

Federal Budget 2022-23 – overview of taxation measures

On 29 March 2022, the Treasurer handed down the Federal Budget for 2022-23.

The Legal Language – forfeiture

Have you ever read something and thought, “I’m not sure what that means” or ‘is that really correct”? Welcome to our series of quickfire interviews that attempt to unravel those interesting words and phrases.

In this edition, we speak to Wills, Trusts & Estates Associate Marcus Schivo, who talks to us about the word he finds interesting, forfeiture.

Advance Care Directives – do I need one?

An Advance Care Directive (ACD) allows you to plan for your medical treatment when you do not have the capacity to consent to or refuse medical treatment.

Have you appointed the best person to manage your financial affairs?

Who and how to appoint your attorneys.

I want to end my Life Interest

Surrendering a life interest – beware the tax implications

A common method to ensure that a family member or spouse of a Willmaker will have the right to reside at a particular property for the rest of their lifetime is for the Willmaker to grant a ‘life interest’ to that individual.

Signing your Will over the internet is here to stay

During the COVID lockdown last year, the Victorian Government passed emergency legislation to deal with the execution of many legal documents, including Wills and Powers of Attorney. The legislation legalised the electronic signing and witnessing of such documents.

Doyles Guide recognition for Rigby Cooke Lawyers Wills, Trusts & Estates team

Rigby Cooke Lawyers is pleased to announce that our Wills, Trusts and Estates team have again been recognised for their exceptional work in Victoria.

Full-blood or half-blood does it matter?

The entitlement of half-siblings upon intestacy made clear again.

To gift or not to gift

The case of Kennedy v Proctor [2021 VSC 521] concerns a dispute as to whether a horse known as ‘Ishker’ was loaned or gifted by Ms Kennedy to Ms Proctor. It was a decision appealed from the Magistrates’ Court to the Court of Appeal.

The Legal Language – personal chattels

Have you ever read something and thought, “I’m not sure what that means” or “is that really correct”? Welcome to our series of quickfire interviews that attempt to unravel those interesting words and phrases.

In this edition, we speak to Wills, Trusts & Estates Partner Rachael Grabovic, who talks to us about the phrase, personal chattels.

How to determine someone’s decision making capacity

If one of your loved ones appears to have reduced mental clarity and is planning to make significant decisions regarding changes to their Will, or is considering signing legal documents such as Enduring Powers of Attorney, how should you proceed?

Family Trust Election – What is it and do I need one?

If your family trust receives franked dividends or has tax losses, the trustee should consider the option of making a family trust election (FTE) in order to access certain tax concessions.

Promises made during your lifetime may bind your estate long after you die

Victoria’s family provision legislation was substantially amended by the introduction of the Justice Legislation Amendment (Succession and Surrogacy) Act 2014.

Will challenges – how much could they get?

In Australia, we have what is known as ‘freedom of testation’. That is, a person is free to leave their assets to whomever they wish when they die.

Wareham v Marsella – Trustees Duties and their implication for Self Managed Super Funds

Court of Appeal Superannuation Case

Managing your own self-managed superannuation fund (SMSF) brings with it estate planning issues. In addition to contemplating who will be entitled to receive your superannuation death benefit on your death, you must also consider who will take control of your fund if you were to lose capacity or die.

The Legal Life – meet Marcus Schivo

Marcus Schivo is an Associate in our Wills, Trusts & Estates group.

Marcus shares his career highlight to date and what he is looking forward to in 2021.

A New Year’s Resolution you should keep – “New Will”

As we reflect on 2020, it highlights how unexpected life can be and how so much can be out of our control. Last year, due to bushfires in the early part of the year and COVID-19 we saw unprecedented financial, economic, and human loss across not only Australia but the world.

Business succession planning – now is the time to take control

As we reflect on 2020, we will no doubt remember how unexpected life can be and how much is out of our control. However, there is one aspect of our lives we can control, and that is our estate planning. As we start 2021 with anticipation and possibly some trepidation, there is no better time than now to take control of your succession plan.

The Legal Life – meet Christian Teese

Christian Teese is a Special Counsel in our Wills, Trusts & Estates group.

The Legal Life – meet our newly promoted Lawyer Marcus Schivo

Marcus Schivo is a newly promoted Associate in our Wills, Trusts & Estates group.

Doyle’s Guide success for Rigby Cooke Lawyers

Rigby Cooke Lawyers is pleased to announce that our Wills, Trusts and Estates team continues to be recognised for their exceptional work in Victoria.

Wills and Estates 101 – Where Wills are in Doubt – Your Rights to Challenge

In the fourth of our Wills and Estates 101 series, we speak with Rigby Cooke Lawyers Wills and Estates Special Counsel, Christian Teese, to answer questions around your rights to challenge the validity of a Will.

Rigby Cooke strengthens its Wills, Trusts & Estates team

Rigby Cooke Lawyers is delighted to announce the appointment of Christian Teese as Special Counsel in our Wills, Trusts & Estates team.

Wills and Estates 101 – Superannuation death benefits

In the third of our Wills and Estates 101 series we speak with Rigby Cooke Lawyers Wills, Trusts and Estates practice lead, Rachael Grabovic, to answer questions around Superannuation death benefits.

Wills and Estates 101 – What is Probate and do I need it?

In the second of our Wills and Estates 101 series we speak with Marcus Schivo, a lawyer in our Wills, Trusts and Estates team, to answer common questions around Probate and what you need to do.

Wills and Estates 101 – The importance of a valid Will

In the first of our introductory series which looks into the world of Wills, Trusts and Estates, we speak to Rosa Bazzanella a Senior Associate at Rigby Cooke Lawyers about some of the questions she frequently encounters in her work.

Video Witnessing in 2020 – Wills and Enduring Powers of Attorney

Recently we discussed how the COVID-19 pandemic has brought to the forefront the importance of having a Will and Powers of Attorney in place. It has also highlighted the challenges of arranging and executing these documents whilst in lockdown.

Wareham v Marsella – Trustees Duties and their implication for Self Managed Super Funds

Court of Appeal Superannuation Case

Managing your own self-managed superannuation fund (SMSF) brings with it estate planning issues. In addition to contemplating who will be entitled to receive your superannuation death benefit on your death you must also consider who will take control of your fund if you were to lose capacity or die.

The Legal Life – meet Rachael Grabovic

Meet Rachael Grabovic, a Partner in our Wills, Trusts & Estates team. Rachael provides specialised legal advice on all aspects of wills and estates including; complex estate planning and succession law advice, wills, powers of attorney, personal trusts, personal wealth structuring, asset protection, superannuation, charitable foundations, probate, estate administration and estate litigation. Rachael is also an appointed and qualified notary public.

Drafting a Will and Powers of Attorney in self-isolation

The COVID-19 medical emergency highlights the importance of having a Will and Powers of Attorney in place. Now is the time to ensure you – and your loved ones – are protected by guaranteeing you have valid and effective medical and financial documents prepared.

Controversial removal of CGT main residence exemption for foreign residents

Legislative measures are currently before Parliament, which will operate to deny foreign residents the ability to access the capital gains tax (CGT) main residence exemption upon the disposal of their Australian dwelling.

Stop tax in its tracks – ATO extends CGT exemption on sale of deceased’s residence

The sale of a person’s main residence (ie their home) is generally exempt from capital gains tax. This exemption is ‘carried through’ to beneficiaries or executors of deceased estates who seek to dispose of the deceased’s main residence, where certain conditions are satisfied.

Rachael Grabovic’s Wills, Trusts & Estates team proficiency recognised

Rigby Cooke Lawyers’ Wills, Trusts & Estates team continues to be recognised for their outstanding work in the Wills, Trusts & Estates space in Victoria.

Promises made during your lifetime may bind your estate long after you die

Victoria’s family provision legislation was substantially amended by the introduction of the Justice Legislation Amendment (Succession and Surrogacy) Act 2014. This Act had the effect of reducing the classes of claimants that may make a claim for provision from a deceased estate, and also the number of claims being filed in Victorian courts against estates.

No Divorce, No worries? No Way!

Remaining married can leave your Will open to challenges

We have seen a number of recent deceased estates where a deceased person remained married at the time of their death, despite having separated from their spouse for a significant period of time prior to their death.

Video didn’t kill the Will

What is a Will? Almost all of us would answer that question by mentioning that it’s a written document setting out who receives our assets when we die.

However, recent court cases have taken a more expansive view as to what they are prepared to accept is a valid Will. The 2017 decision of the Supreme Court of Queensland (QSC) in Re Nichol; Nichol v Nichol & Anor [2017] QSC 220 held that an unsent SMS message was sufficient to constitute a Will.

Court made Wills

The freedom to make a Will and to leave your estate to whomever you choose (called testamentary freedom) is one of the most fundamental principles of succession law in Australia.

Don’t get caught out – Changes to how documents are to be certified commences 1 March 2019

The new Oaths and Affirmations Act 2018 (Vic) (the Act) is set to come into operation on 1 March 2019. The Act updates the processes and requirements regarding oaths, affirmations, affidavits, statutory declarations and certification of documents.

Could your Facebook account put the executor of your Will at risk?

So much of what we do in our lives is now carried out online, so it’s not very surprising that we’re now including access to our digital assets if not in our Wills, in letters of instruction to our executors. However, you may find that by including such instructions, you could actually be putting your executor at risk.

Asset protection considerations for foreign purchasers

If you have recently purchased property in Australia, it is important that you protect your new asset. Most people immediately take out insurance to protect their new property from the consequences of flood, fire, damage and theft. Many people fail to protect their new asset from the consequences of incapacity or death.

The costly consequences of failing to execute a Will

The recent decision of the Supreme Court in Estate of Elzow [2018] VSC 498 highlights the importance of validly executing a Will.

Attorneys and Binding Death Benefit Nominations

A recent Supreme Court decision has highlighted the importance of accurately implementing estate planning for individuals with Self-Managed Superannuation Funds (SMSFs), together with preparing tailored Powers of Attorney.

Don’t fall victim to the unscrupulous management of some aged care providers

Fleur came into see one of our lawyers on behalf of her friend, Norma, who was distressed and unhappy with her accommodation arrangements at an Aged Care Facility and wanted out. This was not a situation where the resident had lost the ability to make decisions for herself, but rather it was a situation where an elderly woman with no family was being taken advantage of.

Step children and family provision claims

In an increasingly diversified world, traditional notions of the definition of a “step-child” are being modified.

In earlier times, a step-child was understood to mean the child of a spouse by a previous marriage.

Does your Will deal with digital assets?

The first question many clients ask when we raise the issue of digital assets is…‘What are they?’

Digital assets can be as basic as your Facebook page and as complicated as cryptocurrencies such as Bitcoin. In the middle, we have many different types of assets such as an online share portfolio, subscription to online newspapers, iTunes accounts or Kindle books.

Greater legal autonomy for medical treatment decisions now in effect

On 12 March 2018, the existing legal framework for medical treatment decision-making, the Medical Treatment Planning and Decisions Act 2016, changed in an attempt to provide greater autonomy to potential patients by enabling them to give advance care directives that are legally enforceable.

Accredited Wills & Estates specialist promoted to Rigby Cooke Lawyers partnership

Rigby Cooke Lawyers is proud to welcome its Wills & Estates practice lead and accredited specialist Rachael Grabovic to the firm’s partnership

New laws clarify executor commissions during estate administration

Solicitors and other professionals who act as executors of deceased estates need to be aware of recent law changes which clarify when commissions can be charged for administering an estate.

New benchmark set for all estates to be treated equally

An appeal to a claim involving a love child, a substantial estate and a diamond encrusted guitar, has reached its conclusion in a decision which sets a precedent for all estates to be treated the same regardless of their size.

Estate planning advice for same-sex couples getting hitched

Following a nation-wide postal survey and many months of debate, the passage of the same-sex marriage legislation came into effect on 9 December 2017. With many same-sex couples organising their weddings, it is essential to understand how marriage can affect your estate planning.

Your responsibilities as a financial attorney or administrator – a snapshot of do’s and don’ts

If you have been appointed as a financial attorney or administrator, whether by the individual or by VCAT, it is essential to understand what is involved in this role. A breach of your legal duties can result in suspension of the role or an order of compensation if brought forth by an interested party.

Rigby Cooke Lawyers’ Tax & Wealth and Wills & Estates expertise recognised

Rigby Cooke Lawyers’ Tax & Wealth and Wills & Estates teams have been recognised by independent survey and review source Doyle’s Guide for their expertise in their respective practice areas.

Should funeral and burial wishes be binding?

Should funeral and burial wishes be binding? This is the question the Law Reform Commission considered when they sought submissions from the public and professionals who work in this area.

Additional stamp duty implication for discretionary trusts

Foreign purchaser additional duty and absentee owner surcharge land tax may apply to Australian discretionary trusts transacting in Victorian residential land where the discretionary trust has potential foreign beneficiaries.

Everything old is new again – protecting your Will or Estate rights

From 1 January 2015, Part IV of the Administration and Probate Act 1958 was amended to change the class of individuals who could make a claim for further provision against a deceased estate.

Charitable giving – are you getting the most from your donation?

If you had said the word ’philanthropy‘ 20 years ago, most people would have looked at you with a quizzical look. Today this word has become as common as the word ’footy’.

Foreigners with assets in Victoria – what happens when they pass away?

An area that is typically challenging in the Wills & Estates space is where a person residing overseas or interstate dies leaving assets in Victoria.

New Financial Year, New Will: 10 Tips to Make Sure it’s Valid

As a new financial year ticks over, financial and strategic planning is common practice for businesses, but one overlooked and yet highly important action to take is the review of your personal Will and estate planning.

Kids behaving Badly – Business Succession Planning

The value of formalising business owners’ arrangements

Shareholders’ and unitholders’ agreements are increasingly being implemented for companies or trusts that involve two or more arms’ length parties. There are very good reasons for this trend: such agreements help to guide decision making, establish governance procedures and stipulate mechanisms to resolve deadlocks.

Hazards of Homemade Wills

In some cases, homemade Wills can cost the deceased’s estate considerable expense. We share with you just how defective a homemade Will can be and how risky it is for appointed executors to try to obtain probate of a homemade Will without legal assistance.

2016-17 Federal Budget: Focus on Superannuation

For super fund members there were a plethora of changes in May’s Budget announcement. Most changes apply from 1 July 2017 apart from the lifetime cap on non-concessional contributions of $500,000, which applies from Budget night (3 May 2016) and counts non-concessional contributions from 1 July 2007.

Do I need a Will in Australia?

I own property in Australia, what do I need to do to protect my interests?

If you have recently purchased property in Australia, then it is imperative that you protect your new asset. The first thing most people do is take out insurance to protect against fire, theft and damage but what most people forget to do is protect their assets against government intervention during times of incapacity or on death.