The Victorian government has continued the Commercial Tenancy Rent Relief Scheme Regulations 2021 (the Regulations) by enacting new regulations to account for the extended lockdown experienced by commercial tenants in Victoria.

Below is a technical summary of the Regulations. Italicised words are defined in the Regulations. The key terms are:

- Eligible lease,

- Eligible tenant,

- Protection period,

- Turnover test,

- Rent relief.

The Regulations operate as follows:

Eligibility for the Scheme

- Eligible Lease

A tenant applying for rent relief under the Regulations must operate under an eligible lease. A lease is an ‘eligible lease’ under Regulation 5 if it:- Was in effect on 28 July 2021;

- Has an eligible tenant as the tenant. Under Regulation 9, a tenant is an eligible tenant if it:

- As at 28 July 2021, carried on a business in Australia or was a non-profit body or a deductible gift recipient;

- Is an SME entity as defined in Regulation 10 with a turnover less than $50 million in FY2020/21;

- Satisfies the decline in turnover test under Regulation 12 (see below);

- Is not subject to any of the exclusions under Regulation 8 (that is, the tenant is not an Australian Government agency or a company in liquidation or listed corporation).

- Is not excluded under Regulation 7 (that is, an agricultural lease).

- Protection period

Unless otherwise specified in the Regulations, the Regulations defines a protection period from 28 July 2021 to 15 January 2022. - Decline in Turnover Test

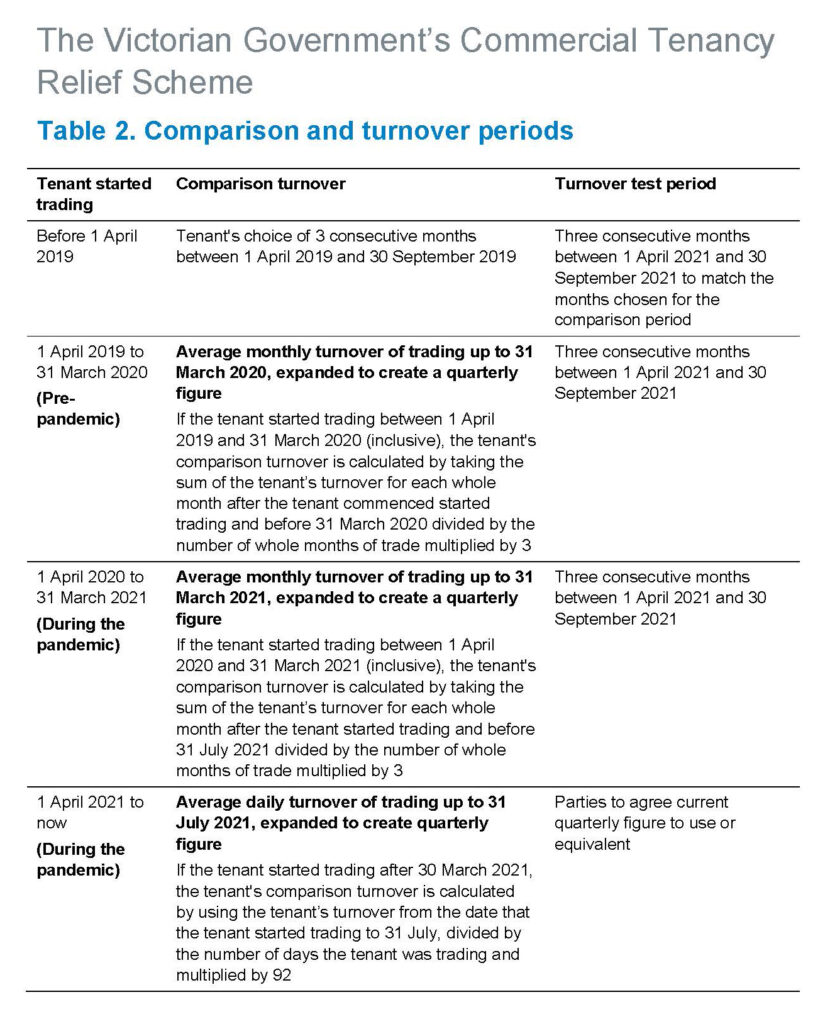

A tenant satisfies the decline in turnover test if its turnover in the turnover test period was at least 30% lower than its comparison turnover (or 15% for a school or a charity). The turnover test period and comparison turnover is subject to when the tenant started trading as set out in the following table: The Regulations provide alternative tests to determine the tenant’s comparison turnover to provide for different circumstances (that is, business restructure or if a business temporarily ceased trading).

The Regulations provide alternative tests to determine the tenant’s comparison turnover to provide for different circumstances (that is, business restructure or if a business temporarily ceased trading).

Rent relief

- An eligible tenant may request rent relief from the landlord under Regulation 27. The request must be in writing and accompanied by a statement from the tenant that it:

- Is an eligible tenant; and

- Satisfies the decline in turnover test and set out any other circumstances that the tenant would like the landlord to consider.

- Further Information

- Within 14 days after making a request for rent relief, the tenant must provide accounting records or business activity statements to the landlord that evidences the turnover the tenant had provided in its statement to evidence it satisfies the decline in turnover test. The tenant must also provide a statutory declaration to the landlord confirming the accuracy of the information provided.

- The tenant’s rent relief request lapses if the tenant does not provide the information within 14 days. The tenant cannot make a further request for rent relief if a tenant allows three requests for rent relief to lapse.

- Landlord’s offer

- Within 14 days after receiving a rent relief request from the tenant pursuant to the Regulations (or such other time agreed between the parties), a landlord must offer rent relief in writing that:

- Relates to up to 100% of the rent payable under the eligible lease during the rent relief period; and

- At a minimum, is proportional to the tenant’s decline in turnover; and

- Provides no less than 50% of the rent relief offered by the landlord is waived; and

- Considers any other circumstances that the tenant had requested for the landlord to consider.

- Within 14 days after receiving a rent relief request from the tenant pursuant to the Regulations (or such other time agreed between the parties), a landlord must offer rent relief in writing that:

- Deemed acceptance by tenant

- Following receipt of the landlord’s offer by a tenant, the tenant and the landlord must negotiate in good faith with a view to agreeing on the rent relief to apply during the rent relief period.

- The tenant is deemed to have accepted the landlord’s offer and a rent relief agreement is deemed to have been made if, on the date that is 15 days after the tenant receives the landlord’s offer of rent relief:

- The landlord and the tenant have not agreed on a rent relief agreement;

- The tenant has not referred the matter to the Victorian Small Business Commission for determination; and

- The landlord’s offer of rent relief complies with the Regulations noted above.

- Rent relief period

If a tenant is an eligible tenant, then the tenant may request rent relief from the landlord for the rent relief period, which under Regulation 28, starts from:- 28 July 2021, if rent relief was requested on or before 30 September 2021; or

- The date of the tenant’s request for rent relief, if rent relief was requested after 30 September 2021, and ends on 15 January 2022.

- Reassessment of rent relief

If a rent relief agreement has been made and the tenant requested for rent relief on or before 30 September 2021 and the tenant began trading before 1 April 2021, then Regulation 29 requires a reassessment of the rent relief agreement on 31 October 2021. - Subsequent rent relief

If the financial circumstances of an eligible tenant has materially changed, the tenant may make a further request to the landlord under that lease for rent relief under Regulation 27. Any new rent relief agreement substitutes the original rent relief agreement. - Payment of deferred rent

Payment of deferred rent cannot be recovered before 15 January 2022 unless otherwise agreed in writing between the landlord and tenant and will be amortised over the greater of the balance of the term (including any extension to the term) or a period of 24 months. If rent is deferred, the landlord must offer the tenant an extension of the term of the lease equivalent to the period of deferred rent and on the same terms that applied under the eligible lease before 28 July 2021. Further deferral of rent may also be required on any eligible leases that were provided rent relief under the COVID-19 Omnibus (Emergency measures) Regulations 2020.

Other Matters in the Scheme

- Land tax relief of up to 25% for landlords of eligible leases.

- Small landlords may also be eligible for payments as part of a $20 million hardship fund.

If you would like to discuss the above Regulations and how they will affect you, please contact our Property or Commercial team for further information.

| Disclaimer: This publication contains comments of a general nature only and is provided as an information service. It is not intended to be relied upon as, nor is it a substitute for specific professional advice. No responsibility can be accepted by Rigby Cooke Lawyers or the authors for loss occasioned to any person doing anything as a result of any material in this publication.

Liability limited by a scheme approved under Professional Standards Legislation. ©2021 Rigby Cooke Lawyers |