A version of this article was first published in the print edition of The DCN for August 2024.

Trade law expert Andrew Hudson shares a roundup of matters discussed at recent CPD forums throughout Australia.

Trade law expert Andrew Hudson shares a roundup of matters discussed at recent CPD forums throughout Australia.

We are delighted to introduce Maddy Lodge, Lawyer in our Workplace Relations group.

The Unfair Contract Terms (UCT) regime has been updated to broaden its application and impose penalties for breach and has been in effect since 9 November 2023.

The Federal Court’s recent Full Court decision in Nguyen v Australian Financial Complaints Authority (2024) FCAFC 77 (Nguyen v AFCA) should be a timely reminder to review and update your estate planning documents in the event of a de facto relationship coming to an end.

On 20 June 2024, the Victorian Government announced the Department of Justice and Community Safety (the department) would lead a review of fees charged for services provided by the Victorian Probate Office within the Supreme Court.

As part of its review, the department sought community feedback in which Rigby Cooke Lawyers’ Wills, Trusts & Estates group provided a submission expressing its concerns on the proposed fee structures and increase in probate fees.

In a significant development for Australia’s administrative review landscape, the Australian Government has unveiled plans to launch the Administrative Review Tribunal (ART) on 14 October, 2024.

This newly established federal body will replace the existing Administrative Appeals Tribunal (AAT), thereby implementing the Labor Government’s election promise to address what were seen as biased political appointments within the AAT.

In our latest Customs & Trade alert, Andrew Hudson summarises some of the relevant provisions to effect changes for licensed customs brokers.

On 1 July 2024, a new clause was inserted into all 155 modern awards providing union workplace delegates specific rights in the workplace.

Rigby Cooke Lawyers is delighted to announce the promotion of eight lawyers across five practice areas.

In an industry replete with acronyms, the AUKUS acronym has gained significant use and attention across the last few years.

With AUKUS now established and its members implementing legislative and administrative arrangements to facilitate the intended outcomes of the partnership, it is timely to examine some of its initiatives.

Rigby Cooke Lawyers is delighted to announce the recent appointment of Julie Callea-Smyth, Partner in our Litigation & Dispute Resolution and Insolvency & Reconstruction practices.

We are pleased to share the news that five of our practice areas, including Corporate & Commercial, Customs & Trade, Planning & Environment, Property and Wills, Trusts & Estates, have been recognised by Best Lawyers in their inaugural edition of Best Law Firms™ – Australia.

On 3 June 2024, the Fair Work Commission handed down its 2024 Annual Wage Review Decision.

On 21 May 2024, the Commercial and Industrial Property Tax Reform Act 2024 received Royal Assent, officially making the Commercial and Industrial Property Tax (CIPT) law. The new CIPT regime will apply to eligible transactions from 1 July 2024.

On 14 May 2024, the Victorian Government introduced the State Taxation Amendment Bill 2024 (Bill) into Parliament. The Bill (if passed) amends the Land Tax Act 2005 to expand the exemption from the vacant residential land tax (VRLT) for holiday homes.

The relationship between Australia and China is a complex one, with the two countries having maintained common interests in trade.

On 14 May 2024, Treasurer Jim Chalmers delivered the Federal Budget for 2024-25 (Budget) announcing significant measures in relation to trade, biosecurity, infrastructure, logistics and manufacturing.

On 14 May 2024, Treasurer Jim Chalmers handed down the Federal Budget 2024-25 announcing significant tax measures.

We are delighted to share the news that Rigby Cooke Lawyers’ Rachael Grabovic TEP, Partner and Notary Public in our Wills, Trusts & Estates group, was successful in winning the STEP Australia Excellence Award for 2024.

We are delighted to share the news that Bill Karvela, Managing Partner, and our Property practice have been recognised for their expertise within the areas of transactional property and real estate matters in the Doyle’s Property Guides for Victoria.

We are delighted to introduce Thalia Livadaras, Senior Associate in our Wills, Trusts & Estates group.

On 20 March 2024, the Commercial and Industrial Property Tax Reform Bill 2024 (Bill) was introduced into Victorian Parliament.

In the recent class action case, Karpik v Carnival plc [2023] HCA 39 (Ruby Princess Case), the High Court of Australia has confirmed that where at least one party to a standard contract for goods or services is acting within, or carrying out business in, Australia the unfair contract term (UCT) laws will apply to that contract.

Rigby Cooke Lawyers is delighted to share the news that Rachael Grabovic, Partner in our Wills, Trusts & Estates group, is a finalist in the Excellence Award category for the STEP Australia Excellence Awards 2024, which was announced earlier today.

Rigby Cooke Lawyers assisted DSV Air & Sea on its 10-year lease agreement with Port of Brisbane Pty Ltd (PBPL) for a warehouse and container hardstand on a 4.8ha site on Fisherman Islands, which was announced recently.

We are pleased to announce that five of our esteemed partners have been recognised in the 17th edition of The Best Lawyers in Australia™.

In a recent Customs & Trade alert titled Modernising the trade system, we wrote about some prospective measures which would assist to facilitate and modernise trade. In the article, it was noted one of the areas in which the modernisation was required was in the form of the regulation applying at the border as the compliance burden has continued to increase for those involved in the international supply chain.

We are delighted to share the news that Rhodie Anderson, Partner – Planning & Environment, and our Planning & Environment practice have again been recognised for their exceptional work in the Doyle’s Planning & Environment Guides for Victoria.

The recent collapse of the Francis Scott Key Bridge in Baltimore due to the collision of a container ship, which led to the tragic deaths of six people working on the bridge, has caused some disruption to that part of the international supply chain using the Port of Baltimore.

As readers would be aware, ‘compliance’ is a term embedded in the international supply chain. However, it is not exclusively reserved to the international supply chain; it is a term used in every aspect of the commercial world and the laws and other regulations governing the commercial world.

In the 2023-24 State Budget, the Victorian Government announced a reform to move away from stamp duty for qualifying commercial and industrial properties, to be replaced by the new annual Commercial and Industrial Property Tax (CIPT).

We are delighted to share the news that Sam Eichenbaum, Senior Consultant and Accredited Specialist in Workplace Relations, and our Workplace Relations practice have been recognised for a 10th consecutive year in the 2024 Doyle’s Employment Guides for Victoria.

On 8 February 2024, in the Trusts, Equity & Probate Division of the Supreme Court of Victoria, Justice Gorton handed down a decision which was largely dependent on proving the existence of a 30-year-old oral agreement affecting husband and wife wills.

The Litigation & Dispute Resolution team at Rigby Cooke Lawyers successfully acted for Central Pier Pty Ltd and its subtenant Atlantic Group in its Federal Court claim against Development Victoria. The case, which was led by Rigby Cooke Lawyers’ Demian Walton (Partner) and supported by Sascha Kenny (Associate), was settled on Monday for a confidential sum.

Twenty twenty-three was the first full year after the restraints on trade imposed by the covid-19 pandemic and the first full year in power for our new federal government. Many things moved, yet many issues remain unresolved. Trade law expert Andrew Hudson outlines some of the highlights for 2023 and predictions for 2024.

Earlier this week, we had the pleasure of welcoming Jenna and Arielle as part of our 2024 Law Graduate Program.

In a recent decision of Chiodo v Silk Contract Logistics [2023] FCA 1047, the Federal Court dismissed a truck driver’s claim that he was an employee and therefore entitled to payment for annual leave and long service leave, as well as superannuation. The Court found that the truck driver was a contractor and not entitled to the benefits usually afforded to an employee.

The Court’s decision re-emphasises the importance that is placed in defining the contractual relationship between parties when assessing whether an individual is an employee or an independent contractor.

The World Trade Organization (WTO) Trade Facilitation Agreement (TFA) came into effect on 22 February 2017 following its ratification by two–thirds of the WTO membership. It is widely recognised for its approach to enhancing trade outcomes which is not wholly dependent on reduction in tariffs or changes to market access but which requires the movement, release, and clearance of goods, including goods in transit. The TFA also includes measures to encourage all agencies operating at the border (including customs agencies) to cooperate on their regulation.

Luckily, Santa uses air cargo for delivery of his presents as international sea cargo experiences new delays, both in the use of the Panama Canal and in movement through the Red Sea and the Suez Canal.

The new changes to fixed-term contract requirements, as well as new obligations for employers under the Sex Discrimination Act (Cth), have now come into effect.

On 12 December 2023, the State Taxation Acts and Other Acts Amendment Act 2023 (the Act) received Royal Assent.

In our latest Property Tax alert, we look at the major changes introduced by the Act to Victorian property taxes, including prohibiting the apportionment of land tax and windfall gains tax in contracts for the sale of real estate.

On 13 December 2023, the federal government released its 2023-24 Mid-Year Economic and Fiscal Outlook (MYEFO). While it is a report on progress following the budget from May 2023, in many ways it is also a half-year report card on the economic state of the nation compared to the anticipated outcomes set out in the previous budget. In general terms, the response to this MYEFO has been positive with the economy appearing to be in a better state than had been anticipated.

On 4 December 2023, the National Heavy Vehicle Regulator’s (Regulator) prosecution case against a transport company and some of its executives, for various breaches of the National Heavy Vehicle Law (NHVL) – including the most serious being Category 1 breaches – was heard at the Downing Centre Court in New South Wales. The case concerned the incident on the Eastern Freeway in April 2020 where four Victoria Police officers were killed whilst conducting a roadside intercept.

In a media release dated 30 October, Trade Minister Don Farrell confirmed that negotiations with the European Union (EU) had reached an impasse with attempts to conclude negotiations on the free trade agreement (FTA) with the EU in the margins of the G7 meetings in Osaka having failed.

Businesses using standard form contracts — including trading terms and conditions, online click-through agreements and independent contractor agreements that are not routinely negotiated — are at risk of breaching strengthened unfair contract term (UCT) laws under the Australian Consumer Law (ACL) which came into force on 9 November 2023.

We are delighted to share the news that Rigby Cooke Lawyers’ Julia Cameron, Partner – Corporate & Commercial, and Lindy Muto, Head of Legal Operations, were successful in the Lawyers Weekly Women in Law Awards 2023 held last Thursday at the Palladium at Crown, Melbourne.

The international supply chain is a complicated and expensive space. Aircraft, container and bulk vessels, airports, cargo, port and stevedore infrastructure require massive investments of time and finance to be planned, commissioned, constructed, and put into operation.

Transport and logistics are the backbone of Australia’s economy, with the need for secure and efficient storage facilities increasing steadily. Whether you are a seasoned logistics professional or a newcomer to the industry, leasing a transport storage facility in Australia can be a complex process. This article serves as a guide to help you navigate the intricacies of leasing a transport storage facility.

Three recent case decisions, two handed down by the Federal Court of Australia (Federal Court) and a third by the Administrative Appeals Tribunal (AAT), will be of interest to those who may deal with sanctions, GST exemptions and customs duty issues relating to proper tariff classification of imported goods.

All members of the Australian supply chain are subject to compliance activity by the Australian Border Force (ABF) and other agencies. On many occasions, after a compliance assessment is completed, the ABF will conclude with details of errors and/or duties due to be paid along with reference that an infringement notice (or notices) may also be issued, inviting the recipient to provide reasons why such a notice should not be issued.

The Unfair Contract Terms (UCT) regime is being updated to broaden its application and impose penalties for breach.

A recent decision by the Supreme Court of Victoria has confirmed the ongoing obligation for vendors to notify purchasers of works affecting the natural surface level of the land when selling land off-the-plan.

We are delighted to share the news that Rigby Cooke Lawyers’ Julia Cameron, Partner in our Corporate & Commercial group, and Lindy Muto, Head of Legal Operations, have been named as finalists in the Lawyers Weekly Women in Law Awards 2023.

The fuel tax credit scheme refunds fuel tax to users of heavy vehicles, machinery, plant and equipment, and light vehicles used off public roads.

One of the key initiatives of the current international reforms in trade facilitation and modernisation is the move to ‘digitise’ the documents used in the supply chain leaving behind centuries of practice relying on use of certain paper documents.

As published by Practical Law and reproduced with their permission, this Note authored by Andrew Hudson, Partner – Customs & Trade, outlines the key requirements and considerations for importing goods into Australia, and the legislation and regulations which govern this. It also highlights opportunities for importers to eliminate, minimise, defer, or recover customs duties. The Note explains the government entities responsible for enforcement and the procedures for challenging decisions by the ABF, DAFF, and other agencies operating at the Australian border.

We are delighted to share the news that Rigby Cooke Lawyers’ Lindy Muto, Head of Legal Operations, won the award for Manager of the Year – Excellence in Technology & Innovation at the 2023 ALPMA Awards held last week at the Melbourne Town Hall.

BS v Active Crane Hire Pty Ltd [2023 FWCFB] 152

On 1 September 2023, BS (Applicant) succeeded in an appeal in the Fair Work Commission against a decision of Deputy President Boyce issued on 25 January 2023. BS had applied for an unfair dismissal remedy against his former employer, Active Crane Hire Pty Ltd (Respondent). The Respondent’s reason for dismissing the Applicant was unsatisfactory performance involving sleeping on duty.

The proposed reforms of the Simplified Trade System Implementation Taskforce (STS Taskforce) have attracted significant attention, largely as a result of the Simplified Trade System Summit, the release of the Simplified Trade System Consultation Paper (which received 29 responses) and, most recently, the publication ‘STS Progress and Opportunities’ released on 29 August 2023.

It has become apparent that there is some confusion about how labour hire regulation impacts the transport industry. A business can be liable for a penalty exceeding $590,000 for using an unlicensed provider, or providing labour without a labour hire licence — so it’s important to get it right.

Yesterday, the federal government introduced the Statutory Declarations Amendment Bill 2023 (the Bill) to make permanent the use of digital execution — electronic signatures and video-link witnessing — in place of the traditional ink and paper.

On 20 July 2023, the Productivity Commission (Commission) issued its Trade and Assistance Review 2021-22.

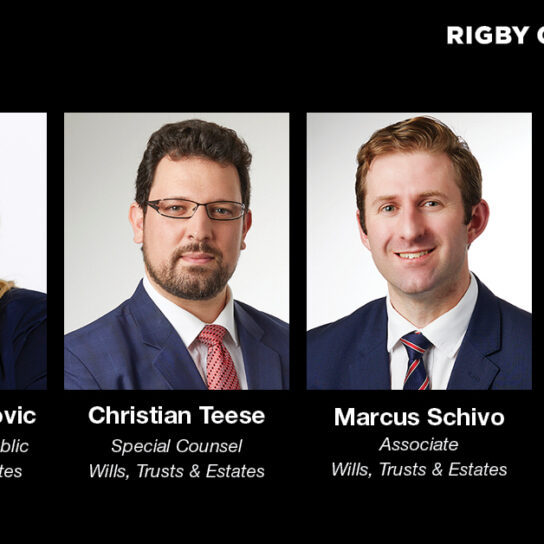

Rigby Cooke Lawyers is pleased to announce that Rachael Grabovic — Partner & Notary Public, Christian Teese — Special Counsel, Marcus Schivo — Associate, and our Wills, Trusts & Estates practice have been recognised in the Doyle’s Wills & Estates Guides for 2023.

The Customs Legislation Amendment (Controlled Trials and Other Measures) Bill 2022 (The Bill) was passed by the Australian Parliament yesterday, which will now form part of the ‘Simplified Trade System’.

On 1 July 2023, the Australian government established the National Anti-Corruption Commission (NACC) under the National Anti-Corruption Commission Act 2022 (NACC Act) to combat corruption and lack of transparency within the federal government and address growing public concerns about corruption of public officials.

A recent Victorian Civil and Administrative Tribunal (VCAT) decision has raised red flags for property developers who undertake capital raisings. The decision increases the risk that as a result of such raisings, equity interests acquired by unrelated investors in development entities may be aggregated under the landholder regime. This aggregation of interests may trigger a significant stamp duty liability, for which the developer and investors will be jointly liable.

On 1 July 2023, the federal government established the National Anti-Corruption Commission (NACC) as Australia’s new federal anti-corruption body. The creation of this new body with wide-ranging powers was the fulfilment of the Albanese government’s election promise to address transparency and corruption issues within the federal government and its various agencies and institutions.

The Personal Property Security Act 2009 (PPSA) came into effect in 2012 and created a uniform regime for parties to register security interests. It replaced over seventy pieces of individual legislation around Australia and aimed to give certainty with respect to the priority of security interests where a grantor enters external administration.

Rigby Cooke Lawyers is delighted to announce the promotions of Tom Hoerner (Litigation & Dispute Resolution) to Special Counsel, and James Anglicas (Litigation & Dispute Resolution) and Biljana Stankovski (Property) to Associate, effective 1 July 2023.

The European Union (EU) has recently released details on its new proposed customs reforms. The proposed reforms will undoubtedly revolutionise the relationship between customs and the private sector, and involves developing new processes for reporting the movement of goods through the supply chain, placing an emphasis on facilitating trade for trusted parties in the supply chain.

On 7 June 2023, the Australian Taxation Office (ATO) issued its finalised ruling TR 2023/1 (the Ruling) which contains the Commissioner of Taxation’s views on the tax residency of individuals. The Ruling was issued following a period of public consultation on the draft ruling (TR 2022/D2).

Most industry and retail superannuation funds, and almost all self-managed superannuation funds (SMSF), allow fund members to make binding death benefit nominations (BDBN).

On 23 May 2023, the Victorian Government delivered the State Budget.

Detailed below is a summary of the significant tax measures and a consideration of the announced measures in greater detail.

During the recent 2023 G7 Summit held in Hiroshima, Japan, from 19 to 21 May, several participating countries announced a range of new sanctions and export controls to be imposed on Russia, including the United States (US) and United Kingdom (UK).

The recent case of Jamsek v ZG Operations Australia Pty Ltd (No 3) (Jamsek) has clarified the application of the superannuation guarantee (SG) regime to truck drivers.

On 9 May 2023, the Australian Federal Treasurer delivered the Australian Federal Budget for 2023-24 (Budget).

On 9 May 2023, Treasurer Jim Chalmers handed down the Federal Budget 2023-24.

Detailed below is a summary of the significant tax measures, and a consideration of the announced measures in greater detail.

Andrew Hudson, Partner of Customs & Trade at Rigby Cooke Lawyers, recently returned from a two-week visit to the European Union (EU), the United Kingdom (UK) and the United States (US). This was Andrew’s first substantive trip overseas since the Covid-19 pandemic. It allowed him to reconnect in person with overseas clients and engage with representatives of the Australian and Victorian governments to discuss initiatives and opportunities overseas.

The Australia-United Kingdom Free Trade Agreement (AUKFTA) is set to commence on 31 May 2023, as announced by the Hon. Anthony Albanese MP, Prime Minister of Australia, during his trip to the United Kingdom yesterday.

The international supply chain has experienced significant turmoil across the past few years from the combined effects of the Covid-19 pandemic, the conflict in Ukraine and the trade disputes between China and many developed nations.

There are many myths and misunderstandings surrounding Wills and estate planning, which often come from television shows and movies. This can lead to misconceptions and half-truths when people attend to their own estate planning, or when dealing with the estate of a deceased family member or friend.

The Unfair Contract Terms regime (UCT) is intended to prevent businesses with a stronger bargaining position from relying on unfair terms in standard form contracts with consumers and/or small businesses.

Rigby Cooke Lawyers is pleased to announce that six of our esteemed partners across six practice areas have been recognised in the 16th edition of The Best Lawyers in Australia™.

The types of controls imposed on those in the supply chain who are licensed by the Australian Border Force (ABF) or other government agencies is a contentious topic. There has been extensive commentary on the obligations imposed, and the significant increase in obligations imposed, on licensed customs brokers (LCBs).

Rigby Cooke Lawyers is pleased to announce that Rhodie Anderson, Partner, and our Planning & Environment practice have been recognised for their exceptional work in the Doyle’s Planning & Environment Guides for Victoria, 2023.

A WorkSafe inspector (inspector) visits a workplace if there has been a safety incident resulting in an injury or fatality, or alternatively in the case of a ‘near miss’, where nobody has actually been injured.

In recent times, the global supply chain has experienced a series of unanticipated strains. The combined effect of the Covid-19 pandemic, shipping congestion, protectionist political actions, lack of product and the conflict in Ukraine caused many in the supply chain to question how global trade may be conducted in the future.

While many people make a Will thinking they can leave their estate assets, including their superannuation benefits, to any person they choose, the Superannuation Industry (Supervision) Act 1993 (Cth) (Act) defines who qualifies to receive a superannuation death benefit following the death of a fund member.

During settlement discussions, it is commonplace for offers and counteroffers to be made between rival parties. While settlement offers are usually reduced to writing in a letter or formal Offer of Compromise, they are often communicated verbally or via email. These seemingly ‘less formal’ modes of communication can create a situation where one party asserts that a legally enforceable settlement agreement has been made, while the other says it has not.

The international supply chain has experienced significant turmoil across the past few years from the combined and simultaneous effects of the Covid-19 pandemic, the conflict in Ukraine and the trade disputes between China and many developed nations.

There has been an increase in investigations by the Australian Taxation Office (ATO) into superannuation guarantee compliance within the transport and logistics industry.

Rigby Cooke Lawyers is pleased to announce that Sam Eichenbaum, Senior Consultant, and our Workplace Relations practice have again been recognised in the Doyle’s Employment Guides for Victoria, 2023.

Case note: Airmaster Corporation Pty Ltd v Mohtadi [2022] VSC 822

Two frequently asked questions we receive from our clients with respect to superannuation are:

Over the past years, the issue of sanctions globally has come to the forefront of public and government discussion largely due to the ongoing conflict in Ukraine. Many businesses that had never previously encountered the issue were forced to deal with sanctions compliance matters.

On 16 December 2022, Attorney-General Mark Dreyfus announced the federal government’s plan to abolish the Administrative Appeals Tribunal (AAT) and replace it with a new administrative review body. The reasons for the proposed abolition were that the AAT had become too politicised through politically motivated appointments of AAT members, which rendered the tribunal dysfunctional.

The Australian Federal Parliament has been busy with several critical issues since coming into office in the second half of 2022, including the introduction of new legislation which will be of interest to many in the Customs & Trade, and Transport industries.