A version of this article was published in the April /May 2025 edition of The DCN. Please note that this was written before the ‘Liberation Day’ tariffs were announced in the US and before the Australian Federal Election.

There have been concerns as to the absence of a clear system or rationale for the various measures and policies being introduced, making it impossible to predict future actions by the United States (US). This can be compared to the Australian regime where proposed developments in policy and legislation are somewhat clearer.

In our latest Customs & Trade alert, Andrew Hudson unravels what the US Government’s incoming trade and customs policies could mean for Australia with the current federal election.

Navigating the unknowns in US trade and customs policies

To quote former US Defence Secretary, Donald Rumsfeld from his comments on 12 February 2002 in a Department of Defence news briefing:

“Reports that say that something hasn’t happened are always interesting to me, because as we know, there are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns — the ones we don’t know we don’t know. And if one looks throughout the history of our country and other free countries, it is the latter category that tends to be the difficult ones.”

In some places, this is described as the ‘Rumsfeld matrix’ and has become a regular source of both amusement and bemusement. However, it could now be considered as a concise commentary on the current state of US economic and customs and trade policy.

Since the last US election, we are regularly asked what is going to happen in the international customs space. Unfortunately, we seem to have ventured into an environment of ‘known unknowns’ and ‘unknown unknowns’ driven by developments and proposed developments in the US and responses by other nations. It is therefore useful to offer a brief summary of significant issues in the US to be compared to the Australian environment.

US developments

Steel and aluminium tariffs

As at the date of writing this article, the US 25% tariffs on imports of steel and aluminium (and products made with such items) are in place and have been the subject of significant negative comments from some countries where exports to the US take place.

Unlike the earlier tariffs on such goods imposed during the first Trump administration, Australia has not been exempted from such tariffs and members of the second Trump administration have made several comments to the effect that Australia is now considered a source of significant dumping into the US.

The measures have not been imposed according to the normal US process for imposing dumping and countervailing duties; they have been imposed by way of an executive order made by President Trump to deal with ‘emergency economic’ circumstances.

2 April – Liberation day

This commentary was written before 2 April 2025, which has been identified as the date on which President Trump will release details of ‘reciprocal’ tariffs being imposed on imports from other countries which his administration believes have imposed tariffs and non–tariff barriers on US exports.

The detailed basis for the imposition of such tariffs and the level of such tariffs is reportedly to be released on 2 April 2025 and while President Trump has claimed that he will be ‘very nice’ in imposing such tariffs, reports are that Australia is among the 15 countries to be targeted by these tariffs.

The concern is that the US will impose tariffs on imports of significant Australian exports including beef and pharmaceutical products. It is anticipated that those new tariffs would be imposed in response to Australia’s GST on imports, our biosecurity regime and our Pharmaceutical Benefits Scheme, all of which are considered to unfairly affect US interests.

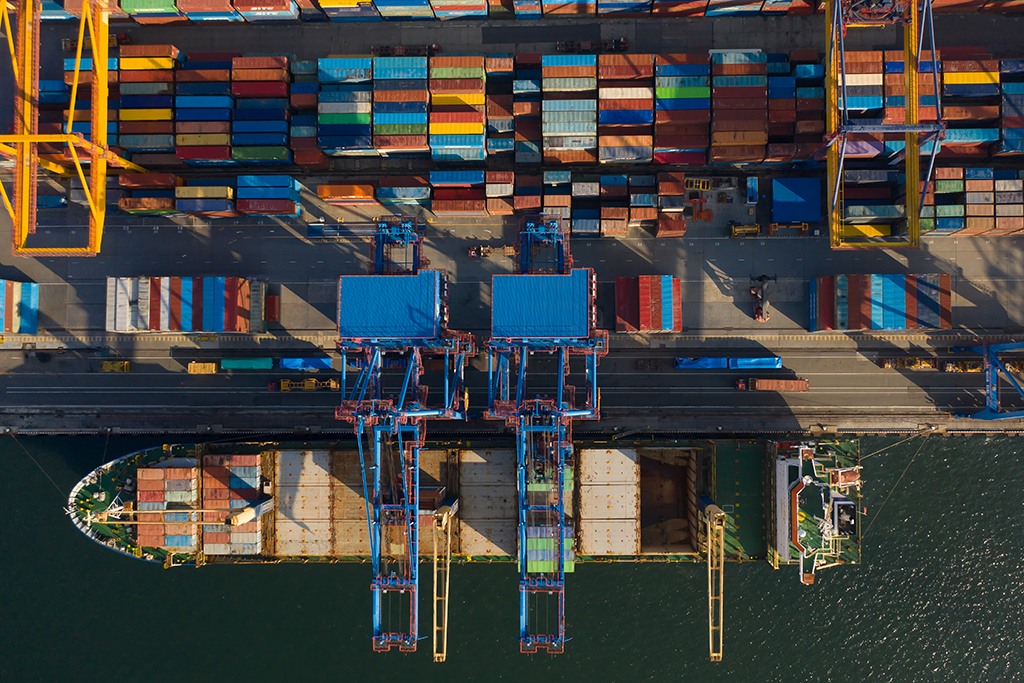

Additional levies on Chinese built, owned and operated vessels (big ones)

The US has proposed introducing additional charges on vessels arriving into the US which are made in China or are operated by Chinese operators. The rationale is reported to be that the Chinese industry is being subsidised or supported by the Chinese government in a manner unfair to the US ship–building industry.

Hearings in the US are currently being conducted by the Federal Maritime Commission to gauge responses from industries which could be affected by the new charges. Unsurprisingly, most comments have been adverse with claims that the charges will disrupt, and damage trade entering US ports, including the imposition of additional costs to be borne by exporters and importers (presumably by way of new levies). Otherwise, there have been observations that the US shipbuilding industry could not produce more vessels in the foreseeable future, which casts doubts on the rationale for the imposition of the charges.

A guide to the basis for the new US trade agenda?

There have been concerns as to the absence of a clear system or rationale for the various measures being introduced, making it impossible to predict future actions by the US, especially when those actions may be withdrawn or varied at short notice.

Clearly, the uncertainty creates problems in making decisions on trade and investment. Many have looked for publications that may assist in understanding the rationale for the actions by the US under the current Trump administration. Recently, a publication written by Stephen Miran, Chair of the White House Council of Economic Advisers, titled ‘A User’s Guide to Restructuring the Global Trading System’ has emerged as what many observers hope is a guide for trying to understand the apparently erratic economic policy.

The main concept behind the publication is that the strength of the US economy and dollar has negatively impacted US trade. As a result, it suggests that the US should implement social, political and economic policies (including unilateral tariffs) to assert its influence over other nations, even at the expense of prior agreements and international relations. ‘America First’ is clearly the concept underpinning many (if not all) of the actions by the US, even at the possible cost of international alliances and agreements.

Australian developments

Unlike the US, the Australian political and trade agenda is one of the ‘knowns’ in international forums and represents a reliable environment in which trade can be conducted. On that basis, it is worthwhile to summarise some of the significant issues.

The Australian Federal Budget and the next Federal election

On 25 March 2025, Federal Treasurer Jim Chalmers delivered the Federal Budget for 2025-26 (Budget), announcing significant measures in relation to trade, border security, infrastructure, transport and manufacturing. One of the main outcomes from the Budget was the significant additional funding provided to border agencies to intervene against the illicit trade in tobacco, vapes and other items. There is little doubt that will lead to even more intense review of those providing services in the private supply chain such as freight forwarders, licensed customs brokers and operators of licensed premises by those border agencies.

As of the time of writing, the Australian Prime Minister has taken the necessary steps to set the date for the next Federal election to be held on 3 May 2025. However, there does not appear to be any significant difference between the major parties on customs and trade matters, whether related to border security, intervention to reduce and eliminate the import of illicit goods, supporting the AUKUS alliance and other defence alliances and further developing Australia’s free trade agenda. In fact, the Coalition has not only supported completion of an FTA with the EU but is also negotiating with Israel for an FTA.

Ban on imports of manufactured stone and proposed ban on imports of ‘forever chemicals’

In recent time, Australia has moved to ban the import of certain items for policy reasons including asbestos and manufactured stone. The Australian Border Force (ABF) has recently issued more guidance on the regime prohibiting manufactured stone.

The next proposed import prohibition will be in relation to ‘forever chemicals’. From 1 July 2025, Australia will ban the manufacture, import, export, and use of the PFAS chemicals PFOS, PFOA, and PFHxS (as well as products containing them) under the Industrial Chemicals Environmental Management Standard (IChEMS).

This regime will be administered by the Department of Climate Change, Energy, the Environment and Water, who will provide direction to the ABF and other agencies on how the prohibition will be implemented.

Commencement of the recent Customs Legislation Amendment Act

The customs amendment legislation, which introduced reforms to the licensing of customs brokers, regulations for licensed premises, and related provisions aimed at strengthening and modernising the Customs Licensing Regime, has previously been discussed. The ABF has published guidance on the implementation of the relevant provisions in ACN 2025/07.

Passage of the transport security legislation

Proposed legislation to amend aviation and maritime security has also been previously discussed. The Transport Security Amendment (Security of Australia’s Transport Sector) Bill 2025 passed through Federal Parliament on Wednesday 26 March 2025 just before the election was called and the government moved into ‘caretaker mode’.

According to the Department of Home Affairs, over the course of the next few weeks, it will provide industry with guidance on how the legislative frameworks are changing, which new obligations may apply to those in the supply chain and examples of how to best meet these obligations. The guidance material will also include information to address common questions raised during consultation.

Contact us

To discuss the recent developments in the customs and trade industry in Australia and the US, please contact a member of our Customs & Trade team.

| Disclaimer: This publication contains comments of a general nature only and is provided as an information service. It is not intended to be relied upon, nor is it a substitute for specific professional advice. No responsibility can be accepted by Rigby Cooke Lawyers or the authors for loss occasioned to any person doing anything as a result of any material in this publication.

Liability limited by a scheme approved under Professional Standards Legislation. © 2025 Rigby Cooke Lawyers |